Unfortunately, I don’t expect the Fed to take this viewpoint. More large rate hikes ahead imo.It takes time for everything else to catch up with the fuel prices.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation and a recession are now here :(

- Thread starter lawpoke87

- Start date

True.. but once people realize fuel is lower, they will start driving again, buying stuff again and inflation will surge again... especially since the Saudis and OPEC are cutting production ..It takes time for everything else to catch up with the fuel prices.

MaybeTrue.. but once people realize fuel is lower, they will start driving again, buying stuff again and inflation will surge again...

Prolly the head that gets cut off possible inflation slow down.especially since the Saudis and OPEC are cutting production ..

Opec cutting production, major & long railway strike, fed increase in interest rate: RecessionSpeaking of inflation and economic impacts, lots of people are sleeping on this looming railway worker strike. A strike would have harmful consequences on many aspects of everyday life.

OPEC oil production cuts won't do as much as you think (related to increased transport costs) I'm more worried about the ongoing natural gas crisis going into the winter.Opec cutting production, major & long railway strike, fed increase in interest rate: Recession

The railway strike is interesting. Not sure what can be done by the president. This isn't the same situation as the Air Traffic Controllers as the Railway workers aren't government employees. Biden can't fire them. The government might take action to end their strike though.

his usual approachis to just throw money at it. So he can give each employee and passenger a big gov check.OPEC oil production cuts won't do as much as you think (related to increased transport costs) I'm more worried about the ongoing natural gas crisis going into the winter.

The railway strike is interesting. Not sure what can be done by the president. This isn't the same situation as the Air Traffic Controllers as the Railway workers aren't government employees. Biden can't fire them. The government might take action to end their strike though.

And just like that, we have news this morning that in cooperation with the White House cabinet secretaries a tentative deal has been reached between labor and corporate. Good for them. Labor has needed more wins for a few decades now, and it will be good if it’s resolved amicably.

I was “team union” on this one. Vacation, sick leave, scheduling all seemed highly unfair. Glad to see a “win” and a costly strike averted.And just like that, we have news this morning that in cooperation with the White House cabinet secretaries a tentative deal has been reached between labor and corporate. Good for them. Labor has needed more wins for a few decades now, and it will be good if it’s resolved amicably.

A good time to buy.Dow is now below 30k as recession fears grow. Next 12-18 months could get rather ugly.

I’ve been trying to build my liquid war chest for just such an occasion.

I will probably look at investing in the next 6-12 months

Same here. I know ur not suppose to try to time the market but it appears a recession is now being priced into the market. Good buying opportunity for those with over a 5 year time frame.A good time to buy.

I’ve been trying to build my liquid war chest for just such an occasion.

I will probably look at investing in the next 6-12 months

I figure the market will eventually match previous highs or we will all die in a nuclear holocaust. Either way, it’s ‘set it and forget it’Same here. I know ur not suppose to try to time the market but it appears a recession is now being priced into the market. Good buying opportunity for those with over a 5 year time frame.

Dow down over 700 points in the last 5 days. Hope you waited. Market is pricing in a recession at this point. Possibly a severe one. Going to have to see some positive economic news before I trust the market at this point. Continued inflationary pressures and zero to negative GDP isn’t market friendly.A good time to buy.

I’ve been trying to build my liquid war chest for just such an occasion.

I will probably look at investing in the next 6-12 months

Yup. I’m holding until At least Jan / Feb.Dow down over 700 points in the last 5 days. Hope you waited. Market is pricing in a recession at this point. Possibly a severe one. Going to have to see some positive economic news before I trust the market at this point. Continued inflationary pressures and zero to negative GDP isn’t market friendly.

A lot more pain on the way for the American people as inflation continued to roar. I keep assuming the Admin will take steps to address this crisis instead of relying solely on the Fed. However, everyday which passes my assumption looks more and more doubtful.

If only someone could have seen this coming

www.cnbc.com

www.cnbc.com

If only someone could have seen this coming

Fed's preferred gauge shows inflation accelerated even more than expected in August

The personal consumption expenditures price index excluding food and energy rose 0.6% for the month after being flat in July.

Unless we push the economy into a recession and demand goes down, I don't see how we intend to harness inflation. The reality is that the base unit of the world economy, energy, is being artificially inflated by Russia & Opec.

Interest rates can't kill that unless they take demand down by causing a recession. The only choice is forcing Opec's prices down with reduced demand.

I don't know what planet Biden is living on, to just now admit we might go into a mild recession. It's likely going to be a mild to probably medium recession. He knew that for sure when he wasn't able to get Opec to budge on output. That move though financially of benefit to Opec, was also to cause more strife to Europe, or to strengthen Russia's position. Either way, we just need to prepare for another recession.

Interest rates can't kill that unless they take demand down by causing a recession. The only choice is forcing Opec's prices down with reduced demand.

I don't know what planet Biden is living on, to just now admit we might go into a mild recession. It's likely going to be a mild to probably medium recession. He knew that for sure when he wasn't able to get Opec to budge on output. That move though financially of benefit to Opec, was also to cause more strife to Europe, or to strengthen Russia's position. Either way, we just need to prepare for another recession.

I think most of this inflationary environment is more related to sentiment than anything else. People expect a recession and therefore they run their businesses in line with perpetuating inflation.

The energy problem is the only real problem that’s putting any inflationary pressure on the economy which isn’t artificial.

I was interested in hearing that many rental units were raising prices. They were arguing that interest rates rising were putting inflationary pressure on their businesses. The only way that’s true is if many multi-family housing units were building those units based on adjustable rate borrowing.

If that’s the case then we may be in for a wild ride. The fed is using the 1980 playbook on combating inflation and it might not work due to the realities of how business assets have been financed during times of extremely low borrowing rates. Not sure what the solution will be these days other than a real societal impact. Ultimately I just hope I can keep my job and not have to sell my house for a loss.if that sort of thing starts to happen we might look at moving from a recession to an all out depression.

The energy problem is the only real problem that’s putting any inflationary pressure on the economy which isn’t artificial.

I was interested in hearing that many rental units were raising prices. They were arguing that interest rates rising were putting inflationary pressure on their businesses. The only way that’s true is if many multi-family housing units were building those units based on adjustable rate borrowing.

If that’s the case then we may be in for a wild ride. The fed is using the 1980 playbook on combating inflation and it might not work due to the realities of how business assets have been financed during times of extremely low borrowing rates. Not sure what the solution will be these days other than a real societal impact. Ultimately I just hope I can keep my job and not have to sell my house for a loss.if that sort of thing starts to happen we might look at moving from a recession to an all out depression.

Come on. Energy runs up the cost on everything. It's what make our products, it's what ships our products. It has an exponential effect on the economy, and you think it's sentiment?I think most of this inflationary environment is more related to sentiment than anything else. People expect a recession and therefore they run their businesses in line with perpetuating inflation.

The energy problem is the only real problem that’s putting any inflationary pressure on the economy which isn’t artificial.

I think the price increases in some consumer and staple products don’t reflect the marginal price increases in shipping and production that we have seen.Come on. Energy runs up the cost on everything. It's what make our products, it's what ships our products. It has an exponential effect on the economy, and you think it's sentiment?

Actually, supply chain is a bigger issue that’s tangible And that I did neglect to account for In my above post.

It is a common fact that the public’s perception of an inflationary environment perpetuates that inflationary environment as people tend to seek employment / raises that will keep up with inflation, which then just creates more inflation.

You’re now blaming business people for this economic mess rather than the federal government for injected a trillions dollars into the economy during a time of shortages in goods and services as well as a Fed who sat on its hands and ignored inflationary pressures so obvious that I called them out? One of the crazier opinions I’ve seen from you.I think most of this inflationary environment is more related to sentiment than anything else. People expect a recession and therefore they run their businesses in line with perpetuating inflation.

The energy problem is the only real problem that’s putting any inflationary pressure on the economy which isn’t artificial.

I was interested in hearing that many rental units were raising prices. They were arguing that interest rates rising were putting inflationary pressure on their businesses. The only way that’s true is if many multi-family housing units were building those units based on adjustable rate borrowing.

If that’s the case then we may be in for a wild ride. The fed is using the 1980 playbook on combating inflation and it might not work due to the realities of how business assets have been financed during times of extremely low borrowing rates. Not sure what the solution will be these days other than a real societal impact. Ultimately I just hope I can keep my job and not have to sell my house for a loss.if that sort of thing starts to happen we might look at moving from a recession to an all out depression.

We may trade in currency... but the real currency is energy.Come on. Energy runs up the cost on everything. It's what make our products, it's what ships our products. It has an exponential effect on the economy, and you think it's sentiment?

You mean businesses have never shown any propensity for greed or exploitation of modern events for their own benefit? I’m sure that everyone is acting completely fairly and rationally with their price increases. /sYou’re now blaming business people for this economic mess rather than the federal government for injected a trillions dollars into the economy during a time of shortages in goods and services as well as a Fed who sat on its hands and ignored inflationary pressures so obvious that I called them out? One of the crazier opinions I’ve seen from you.

Also, I wasn’t only blaming business people (owners / management). Workers have to deal with the inflation, so they ask for more money, which raises prices of the business’ goods and services, which then causes more inflation.

In any case, it took two rather severe recessions for Reagan to deal with the same issue that we’re currently dealing with… but he’s pretty well remembered for what came after so that’s a plus….

Last edited:

Businesses on the whole don’t benefit from run away inflation and the resulting recession. People having less money to buy ones goods is not good for anyone. Your reasoning is faulting as is your understanding of basic economics.You mean businesses have never shown any propensity for greed or exploitation of modern events for their own benefit? I’m sure that everyone is acting completely fairly and rationally with their price increases. /s

Whoa... you mean increasing the minimum wage makes the price of a big mac go up?.... huh..Also, I wasn’t only blaming business people (owners / management). Workers have to deal with the inflation, so they ask for more money, which raises prices of the business’ goods and services, which then causes more inflation.

Business CAN benefit from inflation by increasing their prices at a rate more than what inflation would have required them to do and using the “inflation” excuse to mask that slight gouge.Businesses on the whole don’t benefit from run away inflation and the resulting recession. People having less money to buy ones goods is not good for anyone. Your reasoning is faulting as is your understanding of basic economics.

They don’t all do this, but some absolutely do.

You conveniently omitted the part regarding the resulting recession. Very few businesses benefit from a high inflation followed by a recessionary cycle. Corporate profits are generally down across the board during recessions along with many business failures. There is little reason for any business to support such a path. Your reasoning is flawed.Business CAN benefit from inflation by increasing their prices at a rate more than what inflation would have required them to do and using the “inflation” excuse to mask that slight gouge.

They don’t all do this, but some absolutely do.

Businesses, employees, governments, etc do not work together towards a common goal for all, with the same practices and policies in mind. You can place some of the blame on all of those entities. Everybody is fighting, just not the same fight. Differing interests do that to organizations and individuals. Businesses make decisions they don't like, but feel is necessary in the environment they are in. Same for individuals. That goes for government also.

Everything was not forseen to coagulate like it has. Covid, covid relief, getting back to work, supply chain issues, Russia, Opec, all of it has had a part in the game we are now playing. We are more than likely going to have to go through a recession to get out of the situation. I don't think any policy changes could have navigated us through this fiasco without a recession reset.

Everything was not forseen to coagulate like it has. Covid, covid relief, getting back to work, supply chain issues, Russia, Opec, all of it has had a part in the game we are now playing. We are more than likely going to have to go through a recession to get out of the situation. I don't think any policy changes could have navigated us through this fiasco without a recession reset.

Exactly how are businesses to blame here? They didn’t inject trillions into the economy at a time of labor and goods shortages. They didn’t sit on their hands while inflationary pressures were building. They didn’t come out in May of 2021 and say there was no sign of inflation in the horizon. Even when inflation hit they didn’t dismiss it by calling it “transitory”.Businesses, employees, governments, etc do not work together towards a common goal for all, with the same practices and policies in mind. You can place some of the blame on all of those entities. Everybody is fighting, just not the same fight. Differing interests do that to organizations and individuals. Businesses make decisions they don't like, but feel is necessary in the environment they are in. Same for individuals. That goes for government also.

Everything was not forseen to coagulate like it has. Covid, covid relief, getting back to work, supply chain issues, Russia, Opec, all of it has had a part in the game we are now playing. We are more than likely going to have to go through a recession to get out of the situation. I don't think any policy changes could have navigated us through this fiasco without a recession reset.

Even if they(Biden Administration) had acted as they should have. Even if they not kicked the can a couple of three times.(getting us 10 or 15 feet down the road of ignorance) I don't believe they would have avoided a recession, it just might have come a little earlier.Exactly how are businesses to blame here? They didn’t inject trillions into the economy at a time of labor and goods shortages. They didn’t sit on their hands while inflationary pressures were building. They didn’t come out in May of 2021 and say there was no sign of inflation in the horizon. Even when inflation hit they didn’t dismiss it by calling it “transitory”.

This is what happens when you have a major world catastrophe like Covid, bookended by Russia/Opec.

We certainly wouldn’t have avoided inflation. The question of a recession is rather problematic imo. The recession is going to be caused by the quickness and degree which the Fed has been forced to raise rates to deal with inflation running well over 8%. Take out the last stimulus and take steps more than a year ago to increase domestic O&G production and maybe we’re dealing with 5-6% inflation versus 8.2%. A rate which obviously demands less aggressive Fed action than what we’re currently seeing. Now would that less aggressive action still result in a recession…maybe. If so one would certainly think it would be less severe. All of that is obviously speculation.Even if they(Biden Administration) had acted as they should have. Even if they not kicked the can a couple of three times.(getting us 10 or 15 feet down the road of ignorance) I don't believe they would have avoided a recession, it just might have come a little earlier.

This is what happens when you have a major world catastrophe like Covid, bookended by Russia/Opec.

We all be speculating.All of that is obviously speculation.

So how much worse will a business who acted altruistically, and chose not to gouge customers, fair than one that did in the impending recession? Which one will have more cash on hand to weather the storm?You conveniently omitted the part regarding the resulting recession. Very few businesses benefit from a high inflation followed by a recessionary cycle. Corporate profits are generally down across the board during recessions along with many business failures. There is little reason for any business to support such a path. Your reasoning is flawed.

Now, I'm not saying that either company is inherently wrong for charging what customers are willing to pay, but it is just illustrative of the situation that we find ourselves in.

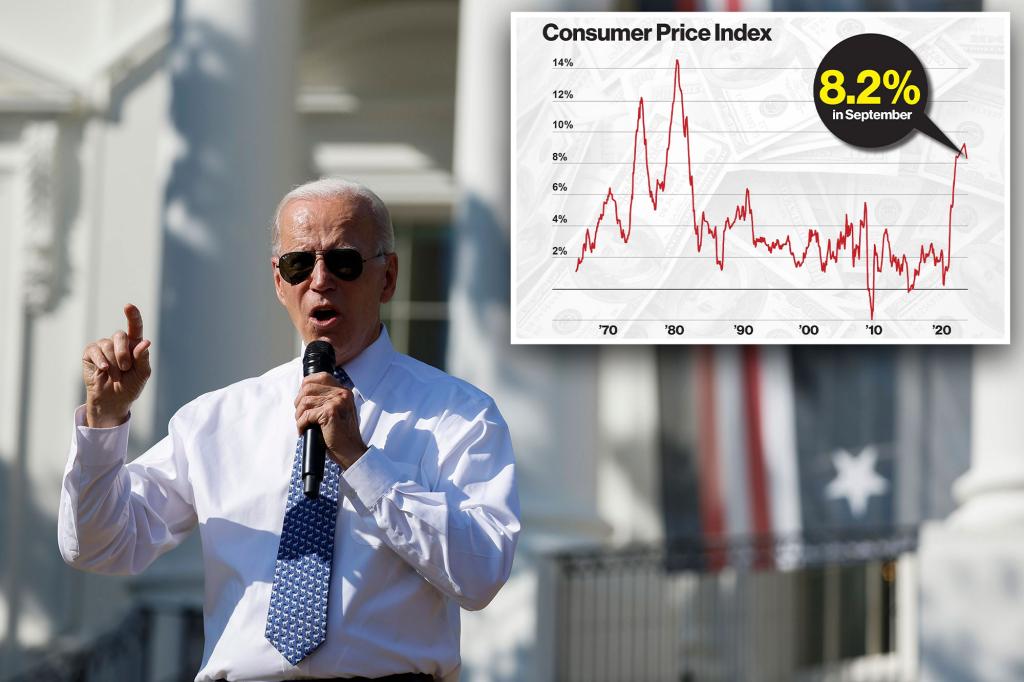

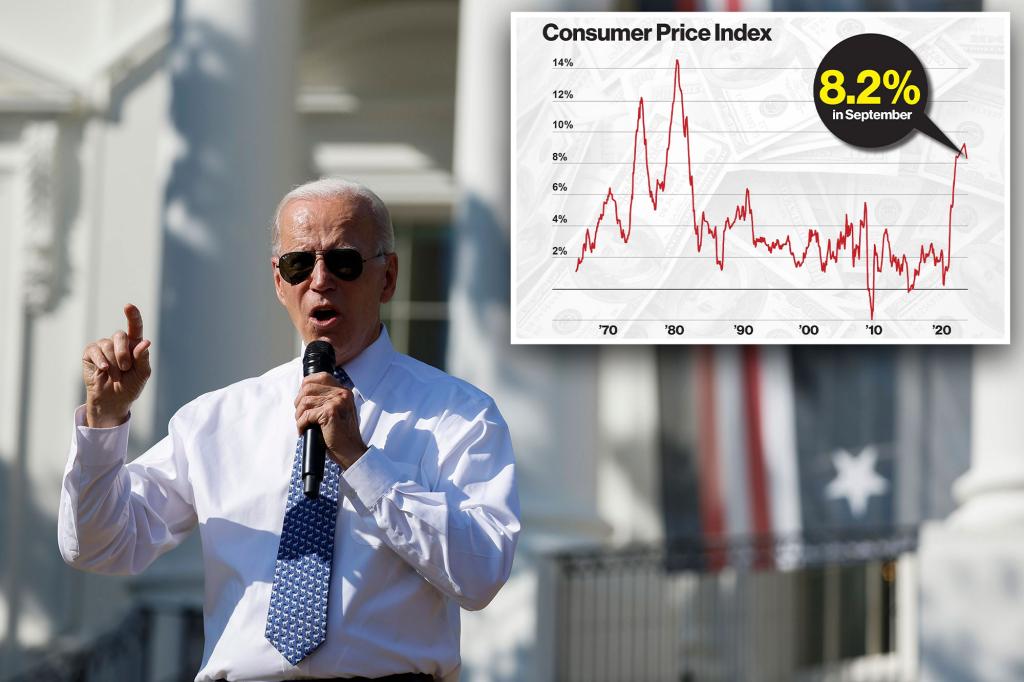

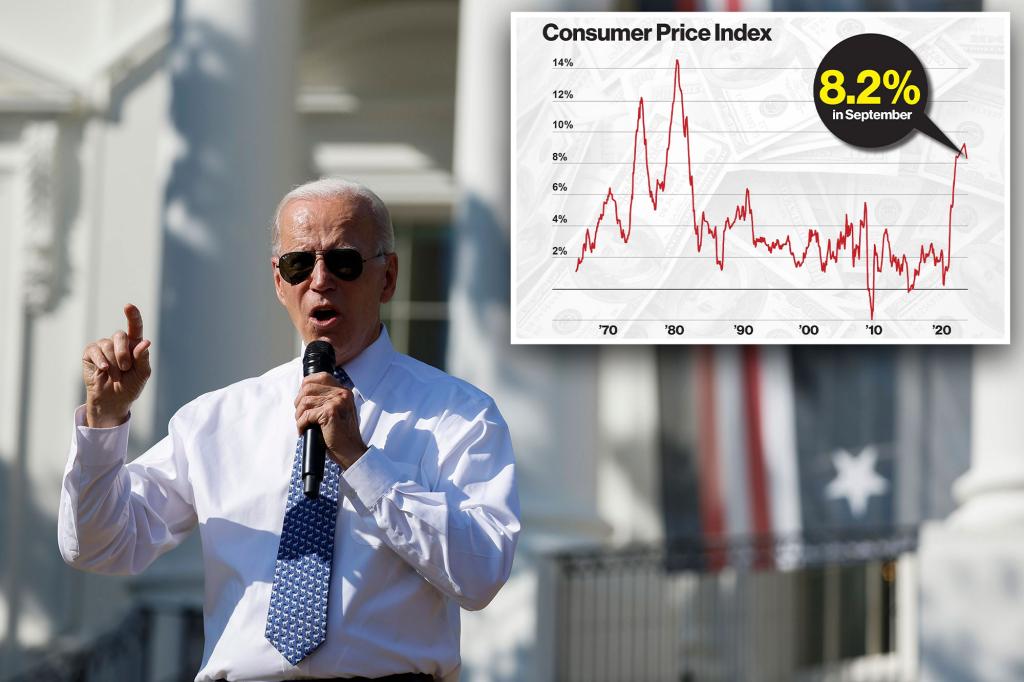

Biden says inflation is 2%...

nypost.com

nypost.com

Biden insists inflation ‘averaged 2%’ — even after data shows 8.2% annual jump

“Inflation over the last three months has averaged 2%, at an annualized rate. That’s down from 11% in the prior quarter,” President Biden insists.

^^^^^^Biden says inflation is 2%...

Biden insists inflation ‘averaged 2%’ — even after data shows 8.2% annual jump

“Inflation over the last three months has averaged 2%, at an annualized rate. That’s down from 11% in the prior quarter,” President Biden insists.nypost.com

what you say when you understand the economic IQ of your supporters.

Similar threads

- Replies

- 9

- Views

- 631

- Replies

- 41

- Views

- 3K

ADVERTISEMENT

ADVERTISEMENT