Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Student debt

- Thread starter aTUfan

- Start date

Only the first $2500 you paid in interest if you make less than $75,000 a year. That’s five months of interest payments for slightly less than half of the borrowers. The average homeowner, at least in 2005, claimed in excess of $10,000 in deduction. The amount Biden is forgiving. It’s twice that in California and New York. The homeowner also has typically purchased an appreciating asset, often with favorable interest rates, insurance, and home improvement incentives supported and paid for by federal programs at no charge to the homeowner. It’s the ultimate middle class welfare. And government supported self retirement fund to supplement social security.

The federal government has decided that it’s socially favorable for people to own homes and go to college and hopefully both. One program works. The other took advantage of most of these people intentionally. Many state governments began to realize this and got out of the business altogether, including, iirc, Oklahoma. That’s the difference.

FWIW, on a personal basis my views are more closely aligned with yours. But that’s not the right call here. I used to argue this stuff for large sums of money. But we can keep going.

I don’t think comparing being allowed to keep more of your own money so you can pay down interest with your own money and then continue to pay your debts with your own money……to simply not being required to pay your debts is very persuasive in the first place.

But even accepting that premise I’m trying to understand your math. The average student has 30Kish in debt and interest rates for federal loans are like 5-7%. How does $2500 cover only 5 months of interest?

You are likely only looking at debt load of undergraduate students who borrowed directly from federal programs exclusively. About 20% of borrowers end up utilizing private lenders whose rates average over ten percent. Typically private loans co-signed by distracted, pressured, or under informed parents. Post pandemic, prices will continue to rise and the debt cap will remain the same. Where do you think kids and their parents go when the government tries to pump the brakes and the smiling counselor at OU slides a brochure across the table?I don’t think comparing being allowed to keep more of your own money so you can pay down interest with your own money and then continue to pay your debts with your own money……to simply not being required to pay your debts is very persuasive in the first place.

But even accepting that premise I’m trying to understand your math. The average student has 30Kish in debt and interest rates for federal loans are like 5-7%. How does $2500 cover only 5 months of interest?

The majority of student loan debt in forbearance or default, the people these programs are trying to help, roughly fit into two categories. They owe less than $10,000 and are either in default more than 2 years with no intention or ability of paying (prisoners, bankruptcy filers and single mothers making less $45,000 are good examples). It’s simply bad debt. Most businesses who engage in unprofitable behavior don’t throw good money chasing bad money at a certain point and write off the debt. You, the tax payer, continue to pay private contractors to try and collect this debt. It’s just good government to cut the loss and government does this all the time with unpaid taxes and fees in a variety of contexts, even fines in criminal cases.

The other category are people who borrowed the maximum or near the maximum for graduate school. Some of these larger loan servicers have as little as $7 billion in repayment versus more than $250 billion eligible for forbearance once the pandemic repayment order expires. Go ask your local banker if that’s a problem. And the outcomes of many of these programs back up that experience. One of the most popular public service loan forgiveness program writes off more than $100,000 for the average borrower after ten years. A program designed to educate and attract teachers, social workers, and cops in night school is mostly doctors and lawyers graduating in the lower half of their class and ending up as public defenders or GPs for the Indian Health Service or whatever. Nearly all of those folks delayed mortgage and families as they balanced ten years of payments, credit card debt, and housing doubling in that period in some parts of the country. They are financial ticking time bombs and we have millions of people right behind them.

I don’t know what you borrowed or paid at TU, but you owe those folks a lot of money. Rather than raise undergraduate tuition or cut programs to continue to finance very expensive lab intensive STEM and health degrees, schools like TU simply doubled law school tuition or more and added chairs. At one point, less than half of the money students paid in law school tuition at TU was actually retained by the law school. The rest was used to keep your undergraduate price, and possibly debt load, low. Thankfully, TU Leadership eventually recognized the moral problem there, but the law school borrowers continue to pay a portion of every undergraduate bill at TU.

As for your “own money” argument, do we really need to go into how much wealth transfer goes into local, state, and federal tax dollars to build the roads, write the flood insurance, build the water, sewer and power lines, collect your garbage, underwrite your flood insurance, get you your first FHA loan interest rate to build equity with “your own money” so you could utilize that program to put new insulation and a discounted HVAC system in your starter home to sell at a return higher than the stock market to move up and out, etc and etc and on and on? People that don’t or can’t own homes are paying for that too, just like supposedly you are being asked to help write off debt.

You’ll notice Ron DeSantis is crickets on this issue. He’s a millionaire lawyer ex-Congressman with degrees from Harvard and Yale, a decorated in theater vet, in his 40s, who still has $19,000 in student loan debt. Even motivated people with means can’t get out from under this problem. Marco Rubio? Times two that amount and it was over $100,000 when he got elected to the Senate iirc.

Last edited:

Were you about the PPE loans that were forgiven for Rep members of congress?nice way to BUY votes, with my money

Ie: Mullin - $989K, Hern: $1M

Did that money not come from taxes?

I’m not sure I would characterize those as loans despite the label. They were government handouts for the “purpose” of keeping people employed and businesses afloat while the government shut down said businesses. It was understood from the start those “loans” were handouts as long as a few conditions were met by the business.Were you about the PPE loans that were forgiven for Rep members of congress?

Ie: Mullin - $989K, Hern: $1M

Did that money not come from taxes?

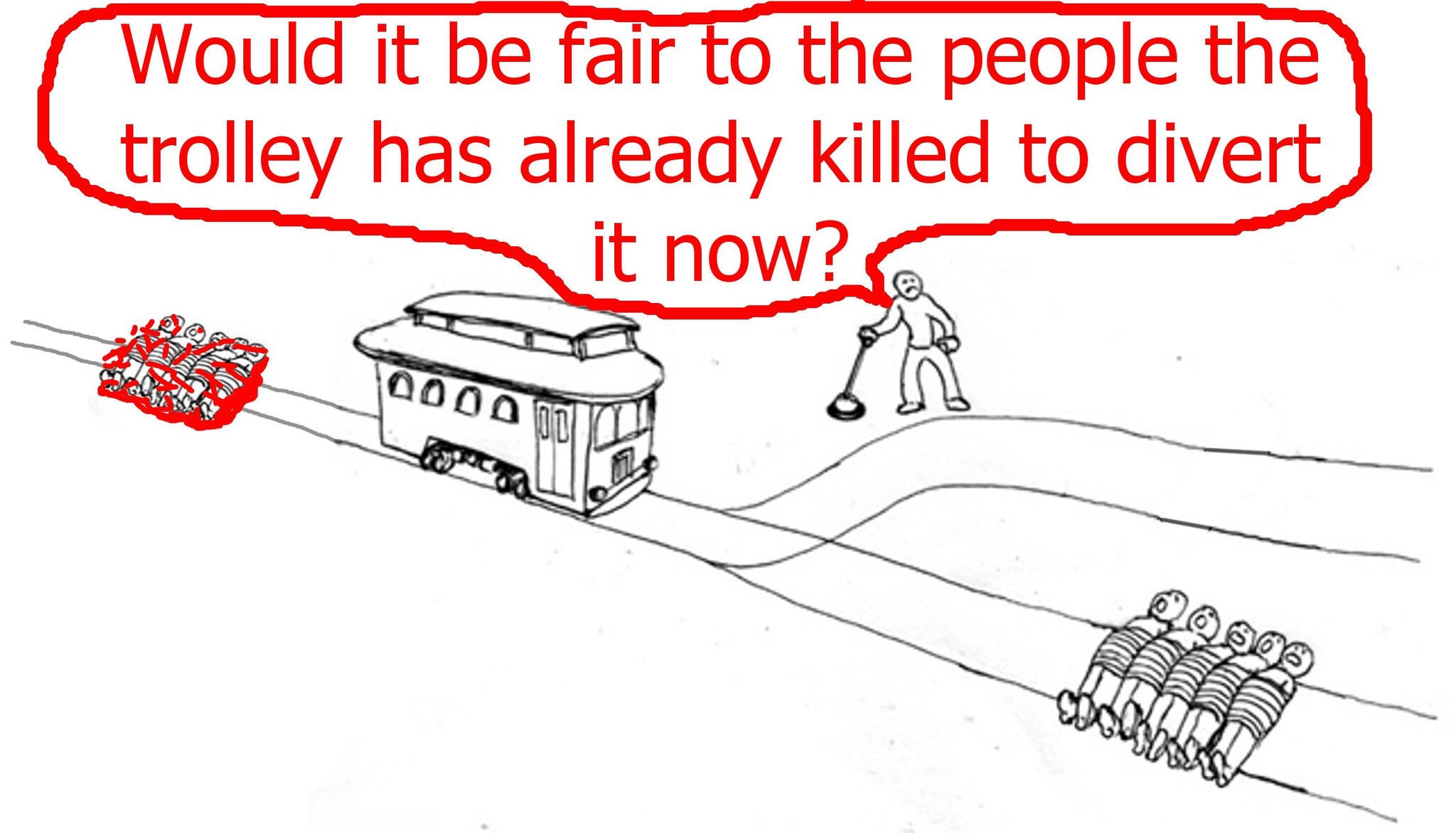

Like the cartoon. However, aren’t we simply tying a new group of people to that track albeit 5 miles down the road? If you’re going to try to address the issues with student loans, college costs, etc.. shouldn’t we also try to address the real problem? All this does is temporarily masks the problem for those who qualify.

I totally agree. I think the portion of the decision capping income based repayment at 5% of income will ultimately help students beyond today, but lowering the cost of education and reducing its ability to inflate artificially needs to be tackled. Without fixing this issue the government will be eating millions in debt every year unnecessarily. I would be happy to see either side of Congress agree to slapping price controls on universities that are going to receive tuition who’s source is federal loans.Like the cartoon. However, aren’t we simply tying a new group of people to that track albeit 5 miles down the road? If you’re going to try to address the issues with student loans, college costs, etc.. shouldn’t we also try to address the real problem? All this does is temporarily masks the problem for those who qualify.

At least this buys us some time to fix the issue and it does help a whole lot of people who have been desperate for help for a long time.

It’s worth noting that Congress changed the law to forbid discharging student loans in bankruptcy in part because so many boomers borrowed money to get in or stay in school to avoid service in the VietNam war. The default and discharge rate on those was astronomical. Some people just never paid and the loan servicers didn’t have adequate records or never even bothered to collect, just submitted the loan guarantee paperwork to the feds. As that mouse made it through the snake, it was a common refrain that people never expected to pay it back and would have done anything to avoid dying in combat, bankruptcy was a small price to pay, especially after Carter pardoned the dodgers abroad.. Most of those dudes belong in a stockade in Kansas still. But the point is the government makes “loans” all the time because that’s the political spin needed to get the aid passed. Good examples are FEMA/SBA loans and foreign aid micro loan programs that everyone knows will likely never be repaid.I’m not sure I would characterize those as loans despite the label. They were government handouts for the “purpose” of keeping people employed and businesses afloat while the government shut down said businesses. It was understood from the start those “loans” were handouts as long as a few conditions were met by the business.

OK.I totally agree. I think the portion of the decision capping income based repayment at 5% of income will ultimately help students beyond today, but lowering the cost of education and reducing its ability to inflate artificially needs to be tackled. Without fixing this issue the government will be eating millions in debt every year unnecessarily. I would be happy to see either side of Congress agree to slapping price controls on universities that are going to receive tuition who’s source is federal loans.

At least this buys us some time to fix the issue and it does help a whole lot of people who have been desperate for help for a long time.

How does TU then market itself as elite AND affordable? How do you offer opportunity for all, but keep hard currency prices down? If people can pay, shouldn’t they for others who can’t? If you can’t raise prices on those who can pay, how do you balance the books? What about those in the middle that can’t quite pay or earn their way through, do they get left behind? Does TU turn into a commuter school again for TCC graduates baling hay and waiting tables over the summer because you can’t work your way through OSU now? A country club for only those paying cash? Price caps in an inflationary economy solve one problem but few others.

Last edited:

Why do I care? What should happen is merit based entry into programs in high demand due to job prospects.OK.

How does TU then market itself as elite AND affordable? How do you offer opportunity for all, but keep hard currency prices down? If people can pay, shouldn’t they for others who can’t? What about those in the middle that can’t quite pay or earn their way through, do they get left behind? Does TU turn into a commuter school again for TCC graduates? A country club for only those paying cash?

As for your “own money” argument, do we really need to go into how much wealth transfer goes into local, state, and federal tax dollars to build the roads, write the flood insurance, build the water, sewer and power lines, collect your garbage, underwrite your flood insurance, get you your first FHA loan interest rate to build equity with “your own money” so you could utilize that program to put new insulation and a discounted HVAC system in your starter home to sell at a return higher than the stock market to move up and out, etc and etc and on and on? People that don’t or can’t own homes are paying for that too, just like supposedly you are being asked to help write off debt.

You can go into whatever you want but allowing people to keep more of the money they earned is fundamentally different from telling them they don’t have to pay their debt.

Still free money from the government/taxpayers that folks had no problem with. The “debt forgiveness” requirements/auditing was also way too easy to get around according to a lot of small business owners I know.I’m not sure I would characterize those as loans despite the label. They were government handouts for the “purpose” of keeping people employed and businesses afloat while the government shut down said businesses. It was understood from the start those “loans” were handouts as long as a few conditions were met by the business.

Now it’s a “my money” issue?

Now it’s a “I have student debt now” issue?

Now it’s a “socialist” issue?

Now it’s a deficit issue?

We could end up in that middle. I have worked it out and regardless of what anyone calculates for "family contribution" I have only 1,000 per month to support college for my daughter. She will also have a 529 with roughly 20,000 in it. All else must come from scholarships and loans, and I will not give away my retirement for massive loans for three children the next decade.OK.

How does TU then market itself as elite AND affordable? How do you offer opportunity for all, but keep hard currency prices down? If people can pay, shouldn’t they for others who can’t? If you can’t raise prices on those who can pay, how do you balance the books? What about those in the middle that can’t quite pay or earn their way through, do they get left behind? Does TU turn into a commuter school again for TCC graduates baling hay and waiting tables over the summer because you can’t work your way through OSU now? A country club for only those paying cash? Price caps in an inflationary economy solve one problem but few others.

So I am bracing for some painful conversations with my very bright 90th percentile SAT daughter in the fall after we turn in the FAFSA and get back bad news. Makes me feel a bit sick.

The mental gymnastics required for this viewpoint are astounding. Even the East German judge gave them a 10/10.You can go into whatever you want but allowing people to keep more of the money they earned is fundamentally different from telling them they don’t have to pay their debt.

I got through school with $550 a month in tuition help from my mom. No parent loans though. 12K in music scholarship and 7.5K in academic. 3.5K in work study and the rest was in Stanford loans and a grant or two. I came out with ~40K in loans.

To be honest, I was able to deal with that amount, even in a job that started out making less than I was told to plan for when I went in to my major. I would have paid it all off in 10 years Had it not been for the Covid pause. But I did make sure to major in something valuable professionally. Had I done something like communications I might have had trouble.

I also worked an extra gig during the weekends and over the summers to meet TU’s yearly rising tuition. The real problem tended to be affording the course materials.

I had family members question why I was going to a private school rather than a state school because they thought I was being wasteful or pretentious. I had to explain that the 19K I got in scholarships from TU meant that TU was ultimately cheaper than OU or OSU which would have given next to nothing In aid.

I had a good friend who followed me from HS a year after I came to TU, and it worked similarly for him.

To be honest, I was able to deal with that amount, even in a job that started out making less than I was told to plan for when I went in to my major. I would have paid it all off in 10 years Had it not been for the Covid pause. But I did make sure to major in something valuable professionally. Had I done something like communications I might have had trouble.

I also worked an extra gig during the weekends and over the summers to meet TU’s yearly rising tuition. The real problem tended to be affording the course materials.

I had family members question why I was going to a private school rather than a state school because they thought I was being wasteful or pretentious. I had to explain that the 19K I got in scholarships from TU meant that TU was ultimately cheaper than OU or OSU which would have given next to nothing In aid.

I had a good friend who followed me from HS a year after I came to TU, and it worked similarly for him.

Last edited:

When the government shuts down businesses they faced the decision of either give those businesses money to continue to pay their workers and hopefully keep their jobs when the shutdowns pass or give that money directly to those workers who are now out of work. The former seemed like the best option longterm for those workers, economy and future tax revenue. Assume why there wasn’t much bitching at the time.Still free money from the government/taxpayers that folks had no problem with. The “debt forgiveness” requirements/auditing was also way too easy to get around according to a lot of small business owners I know.

Now it’s a “my money” issue?

Now it’s a “I have student debt now” issue?

Now it’s a “socialist” issue?

Now it’s a deficit issue?

Fraud in government handout programs is a tale as old as time. In this instance it would have involved submitting false tax returns and payroll deposits/reports. I’m happy to say the IRS has been fairly diligent in auditing these records from what I’ve seen. Anyone he intentionally defrauded the program should go to prison imo.

I got through school via scholarships, a work study program and loans. I fed snakes dead mice in OSU’s zoology Dept during the week and worked at a Stillwater bar on the weekends. Law school was very similar minus the snakes.I got through school with $550 a month in tuition help from my mom. No parent loans though. 12K in music scholarship and 7.5K in academic. 3.5K in work study and the rest was in Stanford loans and a grant or two. I came out with ~40K in loans.

To be honest, I was able to deal with that amount, even in a job that started out making less than I was told to plan for when I went in to my major. I would have paid it all off in 10 years Had it not been for the Covid pause. But I did make sure to major in something valuable professionally. Had I done something like communications I might have had trouble.

I also worked an extra gig during the weekends and over the summers to meet TU’s yearly rising tuition. The real problem tended to be affording the course materials.

I had family members question why I was going to a private school rather than a state school because they thought I was being wasteful or pretentious. I had to explain that the 19K I got in scholarships from TU meant that TU was ultimately cheaper than OU or OSU which would have given next to nothing In aid.

I had a good friend who followed me from HS a year after I came to TU, and it worked similarly for him.

Nice art.. but, somehow, I dont think those people tied themselves to the tracks...

What about diversity? Aren't you going to rate merit based on representation?.......What should happen is merit based entry into programs in high demand due to job prospects.

Traded snakes in cages for snakes in suits? 😉I got through school via scholarships, a work study program and loans. I fed snakes dead mice in OSU’s zoology Dept during the week and worked at a Stillwater bar on the weekends. Law school was very similar minus the snakes.

The mental gymnastics required for this viewpoint are astounding. Even the East German judge gave them a 10/10.

I don't value your opinion

Much appreciated. I wouldn’t want you to.I don't value your opinion

You need to start working with TU now. Don’t wait on the FAFSA. Start the conversation, build or rebuild or restate your long term relationship with the school. It matters more than you think at TU versus a huge school like OSU. And it matters if you start early. My brother got into Harvard. This was before loans. We couldn’t afford it. He went to TU basically for free screwed that up and my parents had to start paying. The plan was for me to go to OU to save cash then finish in two years at TU. Well, once I got my aid offer at OU and I could see my parents would still be paying, I took it to TU as a very brash 18 year old, but someone who had a relationship with the school and a brother in school there, told them what my parents were going to have to pay, why I didn’t want to go to OU, why I thought TU was right for me and could they match it? They did and sweetened the deal a bit. Amazed when I got home with that news my Dad wrote a small check that night, I had to borrow $1,000 directly from the school the first year to do it, but paid it off working two jobs and baling hay at night (which is insanely dangerous if you’ve ever done it in broad daylight). Took me a few years but never looked back. And will always be thankful, loyal and true.We could end up in that middle. I have worked it out and regardless of what anyone calculates for "family contribution" I have only 1,000 per month to support college for my daughter. She will also have a 529 with roughly 20,000 in it. All else must come from scholarships and loans, and I will not give away my retirement for massive loans for three children the next decade.

So I am bracing for some painful conversations with my very bright 90th percentile SAT daughter in the fall after we turn in the FAFSA and get back bad news. Makes me feel a bit sick.

I got through school via scholarships, a work study program and loans. I fed snakes dead mice in OSU’s zoology Dept during the week and worked at a Stillwater bar on the weekends. Law school was very similar minus the snakes.

Just as an aside, and a look at how bad things have gotten with the cost of higher Ed… I was getting ~23K in scholly 6K in parent assistance and working, and still came out with a significant undergrad loan.I got through school via scholarships, a work study program and loans. I fed snakes dead mice in OSU’s zoology Dept during the week and worked at a Stillwater bar on the weekends. Law school was very similar minus the snakes.

In the 70’s my grandfather was able to put 4 consecutive kids through college (some at the same time) with none of them coming out owing a dime and only a couple having much if any scholarships… and he still saved for a good retirement. He was a geologist with Oxy at the time.

I have a better job than he did at the same point in our careers and I’m not sure I could put one kid through school without them owing anything right now. And that’s with them getting good scholarships.

Last edited:

Course materials are now free for all freshman and Carson is working on a cost cap for every class. The ranch boss is tending the cattle and no more slopping the pigs.I got through school with $550 a month in tuition help from my mom. No parent loans though. 12K in music scholarship and 7.5K in academic. 3.5K in work study and the rest was in Stanford loans and a grant or two. I came out with ~40K in loans.

To be honest, I was able to deal with that amount, even in a job that started out making less than I was told to plan for when I went in to my major. I would have paid it all off in 10 years Had it not been for the Covid pause. But I did make sure to major in something valuable professionally. Had I done something like communications I might have had trouble.

I also worked an extra gig during the weekends and over the summers to meet TU’s yearly rising tuition. The real problem tended to be affording the course materials.

I had family members question why I was going to a private school rather than a state school because they thought I was being wasteful or pretentious. I had to explain that the 19K I got in scholarships from TU meant that TU was ultimately cheaper than OU or OSU which would have given next to nothing In aid.

I had a good friend who followed me from HS a year after I came to TU, and it worked similarly for him.

Nothing like an undergraduate ETHICS professor requiring 100 kids every semester to buy the book written by his lover and the kids borrowing $200 paid back over to 10 to 20 years to get peoples attention on this issue. (It wasn’t at TU).

It varies from student to student, but generally TU is cheaper than OU/OSU for the first 5% admitted, the last 5% admitted, Pell Grant students, veterans and first family in college students. In the middle 90% it can vary widely on major, qualifications, ties to the school, whether you are a good “fit” and other factors. Getting started early makes a big difference. Shopping around and applying late and graduating in the middle of your class at Jenks in case you don’t (and won’t) get into Northwestern will likely get you a response you didn’t anticipate. You’ll get in, but maybe not a financing structure you might anticipate. Carson is changing a lot of this, so this message could be completely wrong going forward.

Last edited:

There were a few who sounded the alarm years ago as college costs were increasing at a much greater pace than inflation. This issue never got the attention it deserved. Maybe now we will see some movement in this area. My fear is as long as student loans are being freely given to whomever asks we won’t see a natural market adjustment of these costs. Gets back to your argument of artificially suppressing costs.Just as an aside, and a look at how bad things have gotten with the cost of higher Ed… I was getting ~23K in scholly 6K in parent assistance and working, and still came out with a significant undergrad loan.

In the 70’s my grandfather was able to put 4 consecutive kids through college (some at the same time) with none of them coming out owing a dime and only a couple having much if any scholarships… and he still saved for a good retirement. He was a geologist with Oxy at the time.

I have a better job than he did at the same point in our careers and I’m not sure I could put one kid through school without them owing anything right now. And that’s with them getting good scholarships.

Not when the money you earned is being kept because the government artificially kept the price low for what you purchased.You can go into whatever you want but allowing people to keep more of the money they earned is fundamentally different from telling them they don’t have to pay their debt.

My kids are grown and I paid cash for all my homes. Why should I have to pay taxes to support schools and fund FHA?

"A recent study by an Oklahoma State professor, Vance Fried, (entitled “Opportunities for Efficiency and Innovation: A Primer on How to Cut College Costs”) is instructive. He found that it’s possible to provide a first-class undergraduate education for only $6,700 a year.

The key, he shows, is changing the way that universities are run, and introducing efficiencies, such as cutting the size of the college administration, increasing class sizes, eliminating unpopular programs, and separating research from teaching (although liberal arts colleges don’t cost any less).

None of these will be popular with universities, and one can predict some of the objections: Cutting unpopular programs? But they’re valuable. Bigger classes? But that will lower standards. Separating research from teaching? But it’s part of some college courses, like in the sciences. Cutting the size of the administration? You can be certain that college staff won’t be short of reasons to fight that."

https://www.forbes.com/sites/daniel...deal-harvard-for-6700-a-year/?sh=114ee168406c

The key, he shows, is changing the way that universities are run, and introducing efficiencies, such as cutting the size of the college administration, increasing class sizes, eliminating unpopular programs, and separating research from teaching (although liberal arts colleges don’t cost any less).

None of these will be popular with universities, and one can predict some of the objections: Cutting unpopular programs? But they’re valuable. Bigger classes? But that will lower standards. Separating research from teaching? But it’s part of some college courses, like in the sciences. Cutting the size of the administration? You can be certain that college staff won’t be short of reasons to fight that."

https://www.forbes.com/sites/daniel...deal-harvard-for-6700-a-year/?sh=114ee168406c

those tooWere you about the PPE loans that were forgiven for Rep members of congress?

Ie: Mullin - $989K, Hern: $1M

Did that money not come from taxes?

But brah, Mar-kwayne is undefeated as a straight-up puss maker and breeder.Still free money from the government/taxpayers that folks had no problem with. The “debt forgiveness” requirements/auditing was also way too easy to get around according to a lot of small business owners I know.

Now it’s a “my money” issue?

Now it’s a “I have student debt now” issue?

Now it’s a “socialist” issue?

Now it’s a deficit issue?

Talk about losing votes if the Republicans try to challenge it. Not just Democratic votes either.is it even constitutional? hell the dems dont care

Thank you for the advice. She has warmed a little bit to TU the past year but still seems set on a couple of schools in Chicago despite our trying to keep her realistic by noting how important scholarships will be to make those schools feasible.You need to start working with TU now. Don’t wait on the FAFSA. Start the conversation, build or rebuild or restate your long term relationship with the school. It matters more than you think at TU versus a huge school like OSU. And it matters if you start early. My brother got into Harvard. This was before loans. We couldn’t afford it. He went to TU basically for free screwed that up and my parents had to start paying. The plan was for me to go to OU to save cash then finish in two years at TU. Well, once I got my aid offer at OU and I could see my parents would still be paying, I took it to TU as a very brash 18 year old, but someone who had a relationship with the school and a brother in school there, told them what my parents were going to have to pay, why I didn’t want to go to OU, why I thought TU was right for me and could they match it? They did and sweetened the deal a bit. Amazed when I got home with that news my Dad wrote a small check that night, I had to borrow $1,000 directly from the school the first year to do it, but paid it off working two jobs and baling hay at night (which is insanely dangerous if you’ve ever done it in broad daylight). Took me a few years but never looked back. And will always be thankful, loyal and true.

The TU admissions director went to BK with my wife so perhaps we can try to leverage that a bit as the next few months progress and these options unfold.

Plan your campus visits to Chicago for January when it’s mega cold and early May when everyone is still in winter coats. Problem solved.Thank you for the advice. She has warmed a little bit to TU the past year but still seems set on a couple of schools in Chicago despite our trying to keep her realistic by noting how important scholarships will be to make those schools feasible.

The TU admissions director went to BK with my wife so perhaps we can try to leverage that a bit as the next few months progress and these options unfold.

dems critisized also. as a Taxpaye, i would like to chalange it.Talk about losing votes if the Republicans try to challenge it. Not just Democratic votes either.

I lived there for 2 years and know exactly what you mean.Plan your campus visits to Chicago for January when it’s mega cold and early May when everyone is still in winter coats. Problem solved.

Tried to see Bears game and ended up spending 90% of the game in the bathroom to shield myself from the cold that was causing numbness in my arms and legs.

It’s not a coincidence this was done 2 months before the electionTalk about losing votes if the Republicans try to challenge it. Not just Democratic votes either.

No different than Republicans buying votes with tax cuts.It’s not a coincidence this was done 2 months before the election. “Free” stuff usually equates to votes.

Except for the timing which was the point of my post.No different than Republicans buying votes with tax cuts.

Similar threads

- Replies

- 1

- Views

- 903

- Replies

- 0

- Views

- 527

- Replies

- 58

- Views

- 5K

- Replies

- 9

- Views

- 810

ADVERTISEMENT

ADVERTISEMENT