Since when is a football coach worth more than all of them?Since when is a Nurse worth more per hour than a computer engineer? lol

But, i would like to think that someone thats in charge of someones health is worth more than a keyboard jockey..

Since when is a football coach worth more than all of them?Since when is a Nurse worth more per hour than a computer engineer? lol

That's due the shipping costs increasing, not other labor costs going up for the production of a product. Yes it will have a direct trickle down effect, but not for production costs.Well.. when 1 union gets a big raise.. then other unions will want a big raise.. so.. costs will go up... many unions have wage increase tied to the minimum wage, so they love those increases.. and well if the teamsters get an increase then the cost of raw materials shipped to manufacturers will go up and thus costs overall will go up..

Awful.I’ve been talking about this for years mainly to crickets from our posters. It’s now becoming a reality

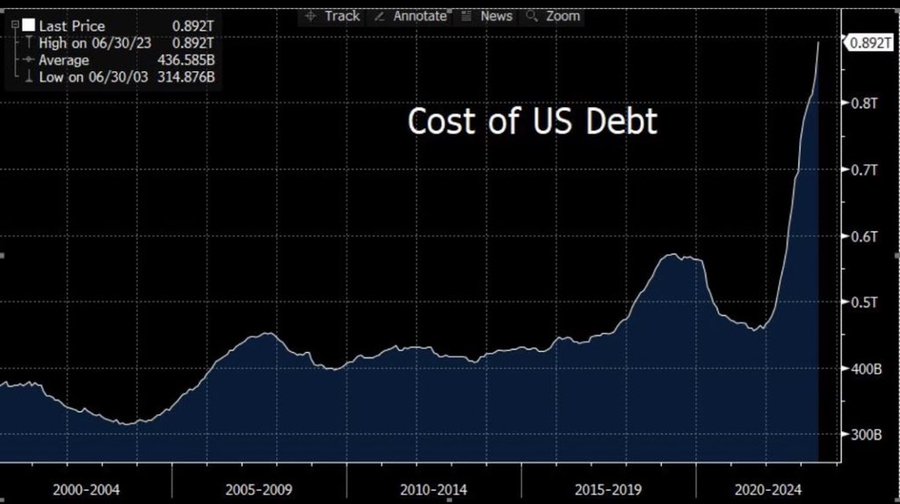

Cost of Debt – Not a New Story….But a Scary Chart The cost of the US debt is now running at a near $1tn annualised pace. In June alone 18% of total US spending accounted for just interest expenses Ht: Valerie Noel LinkedIn

10:23 AM · Jul 20, 2023

https://twitter.com/intent/like?ref_src=twsrc^tfw|twcamp^tweetembed|twterm^1682048525058682880|twgr^|twcon^s1_&ref_url=&tweet_id=1682048525058682880

Good computer guys are looking at 150-200K lol. More if they are consultants.Good RNs are making upwards of $100k these days. No clue what computer guys are bringing down .

No chance the average computer salary in Tulsa is anywhere near $175k. Consultants maybe.Good computer guys are looking at 150-200K lol. More if they are consultants.

In Cali they’re getting closer to 250. It all balances out. I think my company they probably get North of 100 starting. Closer to 130-150 in mid to senior level gigs, and we don’t pay particularly well for the industry and operate in some low COL areas.No chance the average computer salary in Tulsa is anywhere near $175k. Consultants maybe.

This is the industry I'm in and aston is right specialty makes a massive difference.In Cali they’re getting closer to 250. It all balances out. I think my company they probably get North of 100 starting. Closer to 130-150 in mid to senior level gigs, and we don’t pay particularly well for the industry and operate in some low COL areas.

Also it differs based on their specialty. Networking, Cyber Security, Data Engineering, Data Analysis Dayabase Design, Application Mgmt, Front End UI/UX…. etc…

Materials costs are cost of production...That's due the shipping costs increasing, not other labor costs going up for the production of a product. Yes it will have a direct trickle down effect, but not for production costs.

1.9 is a very good number imo. Unfortunately, I see rather strong headwinds in the second half of 2023. As such, I expect GDP to turn negative in the 3rd and 4th quarter. Inflation will remain above the 2% target for at least the next year. Hoping I’m wrong.From CNBC:

WASHINGTON — Morgan Stanley is crediting President Joe Biden’s economic policies with driving an unexpected surge in the U.S. economy that is so significant that the bank was forced to make a “sizable upward revision” to its estimates for U.S. gross domestic product.

Biden’s Infrastructure Investment and Jobs Act is “driving a boom in large-scale infrastructure,” wrote Ellen Zentner, chief U.S. economist for Morgan Stanley, in a research note released Thursday. In addition to infrastructure, “manufacturing construction has shown broad strength,” she wrote.

As a result of these unexpected swells, Morgan Stanley now projects 1.9% GDP growth for the first half of this year. That’s nearly four times higher than the bank’s previous forecast of 0.5%.

Nothing particularly extraordinary about 1.9 GDP, but it's better than some might have thought last year, and considering there's a global shadow conflict going on due to Ukraine.

Some days the meds kick in..More convinced everyday that WATU and aTUfan are the same person.

Keep your head down... Charlie's in the trees..Biden's presidency has been marked by boredom (no daily Trumped up drama and grievances), accomplishments (The infrastructure bill that Trump promised by couldn't deliver), quietly resolving the debt limit curfuffle with Mega House Pubs (no ranting or name calling), revitalizing our relations with allies and NATO, and steering the US through the inflation resulting from Trump's borrowed Chinese trillions. Compared to what might have been, it's been restful, almost crickets. Not perfect, but a pleasant change.

They also mention the constant game of chicken when it comes to raising the debt ceiling. The last time we were downgraded was after the debt ceiling fight in 2011.Fitch downgrades US long term debt. Far too many people lack the basic understanding of what’s occurring on the economic front and choose instead to focus on political nonsense. The following paints a pretty bleak picture of where we are and where we’re going. Zero leadership by anyone on DC

Rising General Government Deficits: We expect the general government (GG) deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022, reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden. Additionally, state and local governments are expected to run an overall deficit of 0.6% of GDP this year after running a small surplus of 0.2% of GDP in 2022. Cuts to non-defense discretionary spending (15% of total federal spending) as agreed in the Fiscal Responsibility Act offer only a modest improvement to the medium-term fiscal outlook, with cumulative savings of USD1.5 trillion (3.9% of GDP) by 2033 according to the Congressional Budget Office. The near-term impact of the Act is estimated at USD70 billion (0.3% of GDP) in 2024 and USD112 billion (0.4% of GDP) in 2025. Fitch does not expect any further substantive fiscal consolidation measures ahead of the November 2024 elections.

Fitch forecasts a GG deficit of 6.6% of GDP in 2024 and a further widening to 6.9% of GDP in 2025. The larger deficits will be driven by weak 2024 GDP growth, a higher interest burden and wider state and local government deficits of 1.2% of GDP in 2024-2025 (in line with the historical 20-year average). The interest-to-revenue ratio is expected to reach 10% by 2025 (compared to 2.8% for the 'AA' median and 1% for the 'AAA' median) due to the higher debt level as well as sustained higher interest rates compared with pre-pandemic levels.

Debt ceiling game is easy to fix. The rest is not and won’t be anytime soon. We’re digging ourselves a hole and no one seems to care because it doesn’t fit into a sixty second sound bite. Hell….even our leadership isn’t addressing this growing problem. Why…because it’s not viewed as politically advantageous.They also mention the constant game of chicken when it comes to raising the debt ceiling. The last time we were downgraded was after the debt ceiling fight in 2011.

By either party. Won't change unless a new party line is adopted by either party.Debt ceiling game is easy to fix. The rest is not and won’t be anytime soon. We’re digging ourselves a hole and no one seems to care because it doesn’t fit into a sixty second sound bite. Hell….even our leadership isn’t addressing this growing problem. Why…because it’s not viewed as politically advantageous.

I’m not optimistic. The two parties are two busy playing gotcha with Hunter Biden, Joe Biden and Donald Trump than having constructive hearings on how we’re going to deal with the skyrocketing deficits in the coming years. Not to mention our rising debt service costs and growing outlays for SS and Medicare. Something will have to give.By either party. Won't change unless a new party line is adopted by either party.

As a whole the Republican party pretended to care but didn't really do anything about it. The Democrats hardly ever acted like they cared, unless it was easy. Like when Clinton had the Tech bubble make a surplus easy to achieve.I’m not optimistic. The two parties are two busy playing gotcha with Hunter Biden, Joe Biden and Donald Trump than having constructive hearings on how we’re going to deal with the skyrocketing deficits in the coming years. Not to mention our rising debt service costs and growing outlays for SS and Medicare. Something will have to give.

It’s not gotcha with Hunter Biden. No one gives a crap if Hunter Biden goes to jail.I’m not optimistic. The two parties are two busy playing gotcha with Hunter Biden, Joe Biden and Donald Trump than having constructive hearings on how we’re going to deal with the skyrocketing deficits in the coming years. Not to mention our rising debt service costs and growing outlays for SS and Medicare. Something will have to give.

The President of the US sure as hell does.It’s not gotcha with Hunter Biden. No one gives a crap if Hunter Biden goes to jail.

That does not mean that the President is willing to use his powers of office to prevent it.The President of the US sure as hell does.

Lol. OkThat does not mean that the President is willing to use his powers of office to prevent it.

Yeah... but, if you use golden glue, you can pass it off as kintsugi.if you bresk a dish and then super glue it back together, it's still a broken dish.

I almost posted similar thoughts.Yeah... but, if you use golden glue, you can pass it off as kintsugi.

www.forbes.com

www.forbes.com

Trump huhAlong this theme is the consistent reporting that in private congressmen from both parties are more centrist and are appalled by our political divisions, especiallyTrump's disregard for democratic norms. But in public those same congressmen and women toe a party line. As result poll after poll shows that voters, especially younger voters, do not believe our system of government still works. If everyone believes that, who will protect democracy?

Trust In U.S. Institutions Hits Record Low, Poll Finds

Only 27% of Americans surveyed by Gallup said they had a great deal or quite a lot of confidence in institutions including the military, the presidency, the Supreme Court and Congress.www.forbes.com

Democratic and Republican voters share a mistrust in the electoral process

A year after the Capitol riot, two-thirds of all Americans believe U.S. democracy is threatened, according to a CBS News poll.www.cbsnews.com

Joe Biden is Vanilla Ice Cream. No one votes for vanilla ice cream unless the other option is your grandma’s fruit cake.Trump huh

Trust in the presidency dropped to 23%, down 15% from 2021, reflecting a declining approval rate for President Joe Biden.

Apparently no one trusts vanilla ice cream either.Joe Biden is Vanilla Ice Cream. No one votes for vanilla ice cream unless the other option is your grandma’s fruit cake.

Would you trust someone who said their favorite ice cream flavor was vanilla? I sure as heck wouldn’t. Even if they were telling the truth… the mundanity is suspicious lol.Apparently no one trusts vanilla ice cream either.

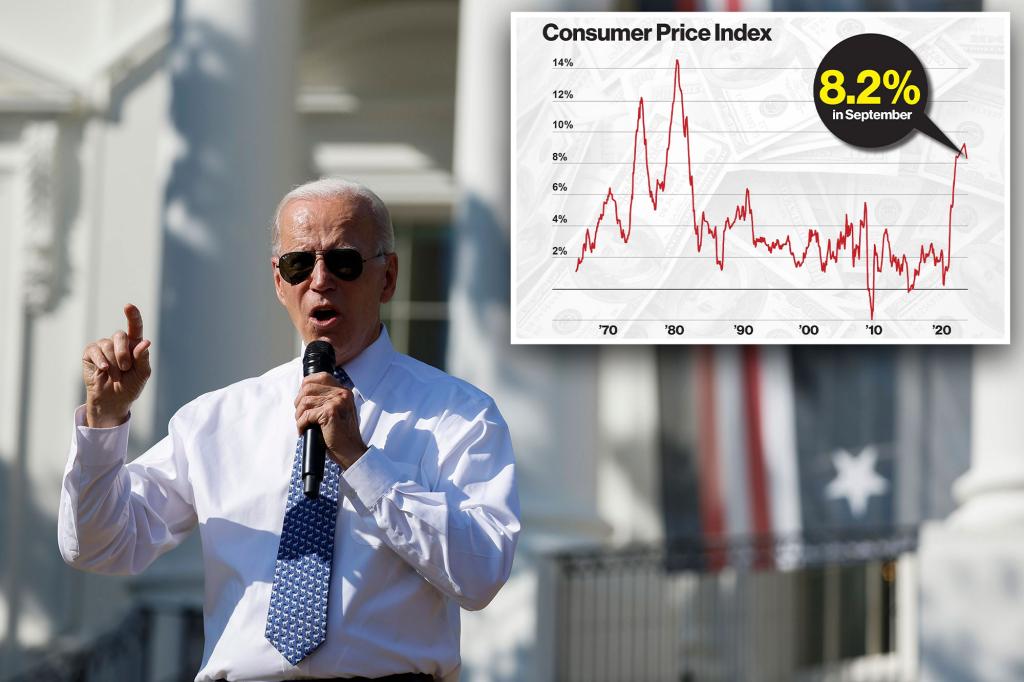

the rate of inflation is dowm, but inflation is not fixed until prices recover to what they were in January 2021.Biden says inflation is 2%...

Biden insists inflation ‘averaged 2%’ — even after data shows 8.2% annual jump

“Inflation over the last three months has averaged 2%, at an annualized rate. That’s down from 11% in the prior quarter,” President Biden insists.nypost.com

That’s not how inflation works…. Unless you want a recession / depression.the rate of inflation is dowm, but inflation is not fixed until prices recover to what they were in January 2021.

if you lock the safe After a robery, you havent solved the robery, and you are still missing the money.That’s not how inflation works…. Unless you want a recession / depression.

After 4 years of being forced to eat my mother in laws fruit cake, vanilla is a satisfying change.Would you trust someone who said their favorite ice cream flavor was vanilla? I sure as heck wouldn’t. Even if they were telling the truth… the mundanity is suspicious lol.