The double down in 2003 during a war was certainly a principled stand. Can you blame him? His Dad was the second most popular President in American history who didn’t get re-elected due to tax policy.Plus Bush cut taxes knowing it would push us back to deficit spending.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

This is the Democratic Party.

- Thread starter lawpoke87

- Start date

l

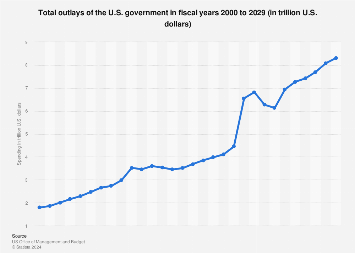

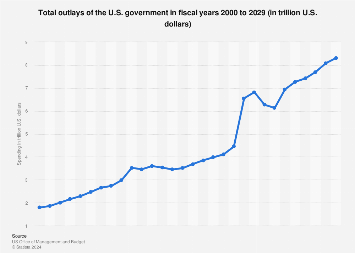

how much of this is due to the increased borrowing rate? (Obviously it’s not the most significant portion. Just wondering)Look at what we’re currently adding to the national debt with no ongoing crisis. There’s an argument for large deficits in times of crisis. There is zero reason for us to be running these kind of numbers in 2023 and 2024. This is not sustainable.

We paid $250B more in debt service in 2023 than in 2022. Not an insignificant increase but doesn’t account for the huge jump in borrowing. Hate to state the obvious but the debt service problem will only grow worse as we continue to borrow trillions. As I said above, there is zero reason to be running these kind of deficits without a national crisis occurring.l

how much of this is due to the increased borrowing rate? (Obviously it’s not the most significant portion. Just wondering)

Interest rates are high too. How much does that play in? If all goes well we will see rates drop.We paid $250B more in debt service in 2023 than in 2022. Not an insignificant increase but doesn’t account for the huge jump in borrowing. Hate to state the obvious but the debt service problem will only grow worse as we continue to borrow trillions. As I said above, there is zero reason to be running these kind of deficits without a national crisis occurring.

Certainly plays a part. The $250B additional debt service cost obviously includes the increase in debt and current interest rates. The problem is even if and when interest rates lower the debt being serviced is increasing rapidly. Thus I would not expect a significant reduction in the debt service cost going forward even under the best case scenario.Interest rates are high too. How much does that play in? If all goes well we will see rates drop.

And we have to find buyers of that debt as the amount of overall debt increases. At a certain point, stomachs may turn.Certainly plays a part. The $250B additional debt service cost obviously includes the increase in debt and current interest rates. The problem is even if and when interest rates lower the debt being serviced is increasing rapidly. Thus I would not expect a significant reduction in the debt service cost going forward even under the best case scenario.

Trumps budget wasn't too shabby.At some point the kids in the RNC are going to put a really good ad together of Senator Biden chiding President Carter about inflation and runaway spending.

Trumps expenditures were somewhat under control until Covid hit. The real question is why are we spending more $2T more a year today than in 2019? Hell…we’re even spending more this year than at the height of Covid when we were passing at trillions in stimulus money. Why? It’s not sustainable and everyone with a basic understanding of debt service and economics understands as much. This should be the #1 issue in the 2024 election cycle. The problem is neither side wants to cut spending because the public wants their free stuff and consequences be damnedTrumps budget wasn't too shabby.

U.S. government - Outlays 2029 | Statista

The total outlays of the United States government added up to about 6.13 trillion U.S.

Yeah....In 83 cent dollars....Big deal!You’re finally starting to understand inflation congratulations. Also your house is worth

more now than when you were buying that 12 oz steak.

A lady down the street from me with 14 years as a VA administrator just had over $700,000 in her and her kids student loans forgiven. The son drives a Maserati much too fast down my street.The real question is why are we spending more $2T more a year today than in 2019? Hell…we’re even spending more this year than at the height of Covid when we were passing at trillions in stimulus money. Why?

No doubt Biden is buying votes with borrowed money. Unfortunately the long term effects are catastrophic. To hell with future generations. These politicians will be dead anyway I suppose.A lady down the street from me with 14 years as a VA administrator just had over $700,000 in her and her kids student loans forgiven. The son drives a Maserati much too fast down my street.

Yep. Perhaps he will make a small detour if he wins. One can hope.No doubt Biden is buying votes with borrowed money. Unfortunately the long term effects are catastrophic. To hell with future generations. These politicians will be dead anyway I suppose.

$$$ for Ukraine, $$$ For Domestic Chip Manufacturing, $$$ for Green Energy Development are part of it, though they are all lower than the debt servicing combined. Also the cost associated with food stamps rose substantially (probably because of inflation) I think the president does need to go after food gouging, especially with lower transportation costs as gasoline has recovered from its high in 2022Trumps expenditures were somewhat under control until Covid hit. The real question is why are we spending more $2T more a year today than in 2019? Hell…we’re even spending more this year than at the height of Covid when we were passing at trillions in stimulus money. Why? It’s not sustainable and everyone with a basic understanding of debt service and economics understands as much. This should be the #1 issue in the 2024 election cycle. The problem is neither side wants to cut spending because the public wants their free stuff and consequences be damned

U.S. government - Outlays 2029 | Statista

The total outlays of the United States government added up to about 6.13 trillion U.S.www.statista.com

You can pick up a used Maserati for 15-20KA lady down the street from me with 14 years as a VA administrator just had over $700,000 in her and her kids student loans forgiven. The son drives a Maserati much too fast down my street.

One thing that I do think everyone should note is that spending as a percentage of GDP is high, but it’s still lower than it was during the Reagan or Obama years. (Don’t confuse this with debt vs GDP)

And some of this spending is targeted at similar growth as it was for Reagan…. Technology, defense and infrastructure… now if only Biden (or Trump) could execute an oil price crash like happened in the 80’s we might be in business.

It was a combination of large exploration, but also more fuel efficient vehicles that drove down US fuel consumption in the 80’s.That might have something to do with the push for electrics and hybrids….keep driving fuel prices down.

And some of this spending is targeted at similar growth as it was for Reagan…. Technology, defense and infrastructure… now if only Biden (or Trump) could execute an oil price crash like happened in the 80’s we might be in business.

It was a combination of large exploration, but also more fuel efficient vehicles that drove down US fuel consumption in the 80’s.That might have something to do with the push for electrics and hybrids….keep driving fuel prices down.

Last edited:

It was called fuel rationing and we all remember it except you.One thing that I do think everyone should note is that spending as a percentage of GDP is high, but it’s still lower than it was during the Reagan or Obama years. (Don’t confuse this with debt vs GDP)

And some of this spending is targeted at similar growth as it was for Reagan…. Technology, defense and infrastructure… now if only Biden (or Trump) could execute an oil price crash like happened in the 80’s we might be in business.

It was a combination of large exploration, but also more fuel efficient vehicles that drove down US fuel consumption in the 80’s.That might have something to do with the push for electrics and hybrids….keep driving fuel prices down.

Notice the trash on the street because inflation was so high they couldn’t afford to pay for workers to clean it up and due to rationing couldn’t get the fuel to haul it off.

You think people are pissed off now and voting for Trump, wait until their garbage isn’t getting picked up and they have to buy a new car at 14% interest because their current vehicle can’t get them to and from work with the fuel that might be available to them.

People living in homes that have doubled in value in the last year shouldn’t be getting multimillion dollar loan relief. And the Maserati is probably 2 or 3 years old purchased new.$$$ for Ukraine, $$$ For Domestic Chip Manufacturing, $$$ for Green Energy Development are part of it, though they are all lower than the debt servicing combined. Also the cost associated with food stamps rose substantially (probably because of inflation) I think the president does need to go after food gouging, especially with lower transportation costs as gasoline has recovered from its high in 2022

You can pick up a used Maserati for 15-20K

People driving Maseratis should not be getting their student loans paid off because the President thinks that he doesn’t have to ask Congress to write the loan off and can just announce in big block letters on mailers and forgiveness letters that the “Biden-Harris Administration” has allowed parent co-signers to consolidate their kids loans under their name and then back date previous government service.

Last edited:

Food stamp spending has tripled under Biden and now both sides agree that 20% of all benefits are fraudulent. They don’t care.$$$ for Ukraine, $$$ For Domestic Chip Manufacturing, $$$ for Green Energy Development are part of it, though they are all lower than the debt servicing combined. Also the cost associated with food stamps rose substantially (probably because of inflation) I think the president does need to go after food gouging, especially with lower transportation costs as gasoline has recovered from its high in 2022

You can pick up a used Maserati for 15-20K

I defended a guy accused of $2.7 million in food stamp fraud. I don’t spend a lot of time in federal court because the penalties are harsh and the rules favor the government. You steal $2.7 million in state court and you are looking at two or three years mandatory minimum. My guy was offered non custodial disposition before arraignment in exchange for future cooperation if needed. We never heard from them again.

I’m aware of fuel rationing and lines at the pump. I’m also aware that in addition to rationing, a lot of other attention was paid to getting fuel prices drastically lower... and a healthy portion of that was fuel economy of vehicles, reduced highway speed limits to promote fuel economy, and the deregulation of oil price controls by Carter first and then Reagan.It was called fuel rationing and we all remember it except you.

Notice the trash on the street because inflation was so high they couldn’t afford to pay for workers to clean it up and due to rationing couldn’t get the fuel to haul it off.

You think people are pissed off now and voting for Trump, wait until their garbage isn’t getting picked up and they have to buy a new car at 14% interest because their current vehicle can’t get them to and from work with the fuel that might be available to them.

It was painful…. But it ultimately helped tank fuel costs and helped stabilize inflationary pressures from transportation which played a large part in the stagflation of the 70’s with OPEC’s price wars.

No one said it was popular… but it helped.

When you’re paying 5% into eternity for every dollar you borrow might I suggest either cutting other spending programs or finding additional revenue sources to fund these programs. As Huffy alluded to the spending on entitlements has skyrocketed under Biden. Again…no cuts or revenue sources to offset. So most of us understand these deficits are unsustainable due in large part to the increasing debt service costs. So we’re taking steps to curb spending right….lol, not a chance. It’s truly fiscal insanity. Where is WATU screaming about deficits and borrowed money or does his concern temporally end when there’s a Dem in the White House?$$$ for Ukraine, $$$ For Domestic Chip Manufacturing, $$$ for Green Energy Development are part of it, though they are all lower than the debt servicing combined. Also the cost associated with food stamps rose substantially (probably because of inflation) I think the president does need to go after food gouging, especially with lower transportation costs as gasoline has recovered from its high in 2022

You can pick up a used Maserati for 15-20K

My question is why are you concerned about this level of deficit spending when it’s lower when normalized to GDP than the last time we were in this situation with Reagan?When you’re paying 5% into eternity for every dollar you borrow might I suggest either cutting other spending programs or finding additional revenue sources to fund these programs. As Huffy alluded to the spending on entitlements has skyrocketed under Biden. Again…no cuts or revenue sources to offset. So most of us understand these deficits are unsustainable due in large part to the increasing debt service costs. So we’re taking steps to curb spending right….lol, not a chance. It’s truly fiscal insanity. Where is WATU screaming about deficits and borrowed money or does his concern temporally end when there’s a Dem in the White House?

High spending proportional to our domestic production seemed to work out well for us last time. What reason do you have for altering course?

By the way, he has proposed increases to revenue in the form of increased taxes for wealthy individuals and corporations.…

In all honesty the capital gains tax rate should be roughly equivalent to the income tax. You shouldn’t pay a much lower tax bill (proportionally) just because you are a day trader instead of a firefighter… but that is incredibly unpopular with people who fund presidential campaigns so it will never happen.

Last edited:

Calculate our debt service costs on $40T at 5%. $50T at 5%. $60T and so on. As Huffy said we have to find buyers for all this debt. At some point those buying countries will use this as leverage against us. Not only will our debt service cost go off the charts but this is also a national security issue.My question is why are you concerned about this level of deficit spending when it’s lower when normalized to GDP than the last time we were in this situation with Reagan?

Do you disagree? The numbers are the numbers.

The exact same could have been said in 1981. They would have just been freaking out about Billions instead of Trillions.Calculate our debt service costs on $40T at 5%. $50T at 5%. $60T and so on. As Huffy said we have to find buyers for all this debt. At some point those buying countries will use this as leverage against us. Not only will our debt service cost go off the charts but this is also a national security issue.

Do you disagree? The numbers are the numbers.

We are not the only country suffering the effects of this…. It’s really a global issue and it’s effecting adversaries as well as allies.

I show GDP in 1981 at $3.2T and debt at $1T. GDP was over 3x more than total debt.The exact same could have been said in 1981. They would have just been freaking out about Billions instead of Trillions.

Debt is currently 130% greater than GDP and growing at a substantially faster pace.

That is a huge shift from 1981. The situations aren’t remotely similar.

When you only balance the budget 4 years out of the last 55, at one point or another the debt will exceed the GDP. It's only a matter of time.I show GDP in 1981 at $3.2T and debt at $1T. GDP was over 3x more than total debt.

Debt is currently 130% greater than GDP and growing at a substantially faster pace.

That is a huge shift from 1981. The situations aren’t remotely similar.

You do know that’s just the debt they let you know about, right?I show GDP in 1981 at $3.2T and debt at $1T. GDP was over 3x more than total debt.

Debt is currently 130% greater than GDP and growing at a substantially faster pace.

That is a huge shift from 1981. The situations aren’t remotely similar.

Absolutely. Didn’t have the time or energy to address our IOUs outstanding. Paints quite the bleak picture. If a private company would have done what our government has with our debt and the reporting of the same the officers would be in jail.You do know that’s just the debt they let you know about, right?

This happened to Obama in 2013, so they started recalculating the figure to delete debt one agency owed another without accounting for forward obligations outside government. That kept it under 100% until he was out of office.When you only balance the budget 4 years out of the last 55, at one point or another the debt will exceed the GDP. It's only a matter of time.

The situations are very similar aside from the total debt load that are carrying while going through the crisis. What you don’t acknowledge is what happens if you drastically cut spending to try and tackle that high Debt to GDP ratio….. if you do that, your GDP suffers severely and the debt to GDP skyrockets.I show GDP in 1981 at $3.2T and debt at $1T. GDP was over 3x more than total debt.

Debt is currently 130% greater than GDP and growing at a substantially faster pace.

That is a huge shift from 1981. The situations aren’t remotely similar.

You are worried about the numerator in the equation…. I’m worried about the denominator because it can have larger impacts.

What gets me is that really smart people, the faculty at the Wharton school, groups of Harvard economists, the editorial board of the Financial Times, etc. All suddenly started saying around 2017, and still say, that we have about 20 years to turn it around using traditional methods but the longer we delay the greater chance of a catastrophic event. These same people that were Team Bush and especially Team Obama on fiscal policy. They now say something that makes 2008 look like chump change that we can’t stimulus our way out of is inevitable. And worse than the Great Depression. A world wide market event that takes a decade or longer to recover from. And as we get closer not only do our options get to be fewer, their likelihood of success becomes lower and the impacts if we fail will become greater. Meanwhile our leader doesn’t remember that he ate cottage cheese for lunch.

We aren’t talking about market crash and people losing their retirement or the stock market rebounding. We are talking people in large numbers without food and freezing to death.

We aren’t talking about market crash and people losing their retirement or the stock market rebounding. We are talking people in large numbers without food and freezing to death.

Nobody knows outside select members of Congress and the executive branch what the IC owes and efforts to do a forensic audit on the Pentagon were destroyed during 9/11 and have never fully resumed. They owe so much with such poor record keeping they were doing debt “estimates” and “obligation projections” during the war. They owe so much, they don’t know how much they owe or who they owe it to.Absolutely. Didn’t have the time or energy to address our IOUs outstanding. Paints quite the bleak picture. If a private company would have done what our government has with our debt and the reporting of the same the officers would be in jail.

Which isn’t surprising when you consider agencies like Energy and Agriculture have so many grant programs, with no uniform accountability, no single bureaucrat at the top tracking it, they have no idea how much money they give out, how much was unspent, and what it all bought.

Last edited:

Aside from the total debt? This is 100% about the total debt. You can’t dismiss the most important element of this pending disaster. What do we have to service…the TOTAL DEBT.The situations are very similar aside from the total debt load that are carrying while going through the crisis. What you don’t acknowledge is what happens if you drastically cut spending to try and tackle that high Debt to GDP ratio….. if you do that, your GDP suffers severely and the debt to GDP skyrockets.

You are worried about the numerator in the equation…. I’m worried about the denominator because it can have larger impacts.

As Huffy correctly states, if we continue down this path we aren’t talking about a slowdown in GDP or a recession. We are talking about people freezing and starving. Find a way to go back to 2019 spending levels adjusted to inflation. Hell….do something. I would even be relatively happy at this point to hear someone with this Admin formulate a plan and present it to the American people. Doesn’t take an PHD in economics to look at our growing debt and understand that we will reach a point where we won’t be able to service the same and provide adequate spending for other budget items. Why is math so hard for so many.

Our only hope is that the people with gavels and guns start to assert themselves. When debt servicing is larger than the Pentagon budget and they aren’t getting the fuel and ammo they need, we will hear about it forcefully. Similarly, about the time all of this goes a$$ over tit, you figure the judges with responsibility over the border and prisons will start sounding the alarm and making reversible extra constitutional decisions that force change. Apparently the Fed is impotent.Aside from the total debt? This is 100% about the total debt. You can’t dismiss the most important element of this pending disaster. What do we have to service…the TOTAL DEBT.

As Huffy correctly states, if we continue down this path we aren’t talking about a slowdown in GDP or a recession. We are talking about people freezing and starving. Find a way to go back to 2019 spending levels adjusted to inflation. Hell….do something. I would even be relatively happy at this point to hear someone with this Admin formulate a plan and present it to the American people. Doesn’t take an PHD in economics to look at our growing debt and understand that we will reach a point where we won’t be able to service the same and provide adequate spending for other budget items. Why is math so hard for so many.

Last edited:

The insanity of this is if we continue to follow the current path it’s not a matter of IF our debt service expenditure becomes larger than our defense budget but when. It’s a mathematical certainty. The fact that people don’t understand the basic math behind this statement is troublesome. Maybe it’s as simple as they don’t want to understand it. The ole “I’ll be dead and my kids can deal with my fiscal mismanagement”. Just keep borrowing $2T, $3T, $4T a year to keep the Matrix going. Give me the blue pill.Our only hope is that the people with gavels and guns start to assert themselves. When debt servicing is larger than the Pentagon budget and they aren’t getting the fuel and ammo they need, we will hear about it forcefully. Similarly, about the time all of this goes a$$ over tit, you figure the judges with responsibility over the border and prisons will start sounding the alarm and making reversible extra constitutional decisions that force change. Apparently the Fed is impotent.

That’s exactly what is going on. Boomer “live forever” syndrome.The insanity of this is if we continue to follow the current path it’s not a matter of IF our debt service expenditure becomes larger than our defense budget but when. It’s a mathematical certainty. The fact that people don’t understand the basic math behind this statement is troublesome. Maybe it’s as simple as they don’t want to understand it. The ole “I’ll be dead and my kids can deal with my fiscal mismanagement”. Just keep borrowing $2T, $3T, $4T a year to keep the Matrix going. Give me the blue pill.

Impose an estate tax so the Baby Boomers can finally pay their fair share (after they are dead)The insanity of this is if we continue to follow the current path it’s not a matter of IF our debt service expenditure becomes larger than our defense budget but when. It’s a mathematical certainty. The fact that people don’t understand the basic math behind this statement is troublesome. Maybe it’s as simple as they don’t want to understand it. The ole “I’ll be dead and my kids can deal with my fiscal mismanagement”. Just keep borrowing $2T, $3T, $4T a year to keep the Matrix going. Give me the blue pill.

How much will revenue that raise?Impose an estate tax so the Baby Boomers can finally pay their fair share (after they are dead)

Great idea millennial disruptor. Saddle Gen X with paying for their aging parents, their under skilled and entitled millennial kids, then take 35% of their inheritance. Run for Congress, PLEASE!!Impose an estate tax so the Baby Boomers can finally pay their fair share (after they are dead)

Looked it up. Raising Estate tax to 2001 levels would raise around $150B. Not an insignificant amount but nowhere near the sum needed to offset the record increases we’ve seen in spending over the past few years. Hell….barely covers half of the increase in debt service cost from 2022 to 2023. Going to need more revenue along with cutting expenditures.How much will revenue that raise?

Oh…. So you’re only willing to service the debt and make cuts that are painful when they’re painful to other people? That’s what I thought.….Great idea millennial disruptor. Saddle Gen X with paying for their aging parents, their under skilled and entitled millennial kids, then take 35% of their inheritance. Run for Congress, PLEASE!!

Similar threads

- Replies

- 37

- Views

- 1K

- Replies

- 752

- Views

- 15K

- Replies

- 6

- Views

- 474

ADVERTISEMENT

ADVERTISEMENT