IMF Warns Inequality Is a Drag on GrowthSays Rising Income Inequality Is Weighing on Global Economic Growth

Updated March 13, 2014 8:28 p.m. ET

WASHINGTON--The world's top economic institution is sounding the alarm about a growing chasm between rich and poor, warning that rising income inequality is weighing on global economic growth and fueling political instability.

The International Monetary Fund's latest salvo came Thursday in a top official's speech and a 67-page paper detailing how the IMF's 188 member countries can use tax policy and targeted public spending to stem a rising disparity between haves and have-nots.

IMF Managing Director Christine Lagardehas made the issue a high priority for the fund, warning?along with some of the fund's most powerful shareholders?that inequality is threatening longer-run economic prospects. Last month, Ms. Lagarde said the income gap risked creating "an economy of exclusion, and a wasteland of discarded potential" and rending "the precious fabric that holds our society together."

The IMF is wading deep into a problem that no less than President Pope Francis have called a defining issue of our time, and the fund's potential prescriptions are likely to be a lightning rod for debate. They include raising taxes and redistributing wealth.

"Redistribution can help support growth because it reduces inequality," David Lipton, the fund's No. 2 official and a former senior White House aide, said in a speech Thursday at the Peterson Institute for International Economics. "But if misconceived, this trade-off can be very costly."

The IMF has a long history of studying economic disparities from an academic perspective. But the political turmoil spreading across Ukraine, Egypt and Venezuela in recent years underscores their real-world importance. In each of those countries, income inequality and poor economic management helped propel widespread unrest.

The financial crisis exacerbated the problem in rich nations. Surging joblessness after the 2008 financial meltdown gave traction to groups such as Occupy Wall Street and the Robin Hood Tax Campaign, a prominent nonprofit coalition seeking higher tax revenue to back programs benefiting poorer Americans.

Inequality in several advanced economies, including the U.S., has returned to levels not seen since before the Great Depression, the fund said. In Greece, the epicenter of Europe's debt woes for several years, the poorest 10% of the population was hit hardest by a cut in the tax-free threshold for income taxes, according to IMF data. Economic hardship there has been cited as a significant factor in the rising popularity of the fascist movement Golden Dawn and related violence against immigrants."There's a sense that the burdens of the crisis have been unevenly distributed, that the middle classes and the poor have footed more of the bill of the crisis than the economic elite," said Moises Naim, a senior economist at the Carnegie Endowment for International Peace and Venezuela's former trade minister.

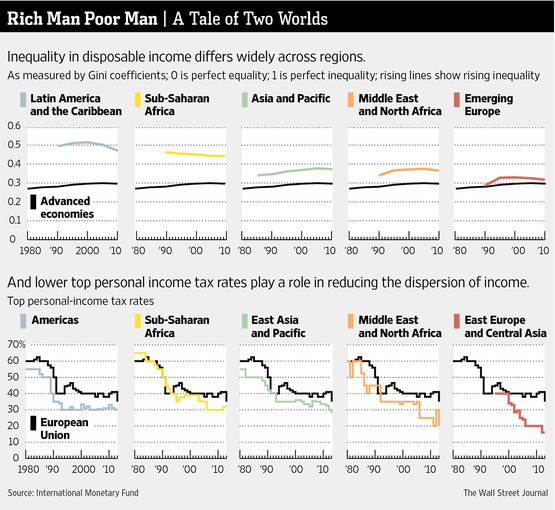

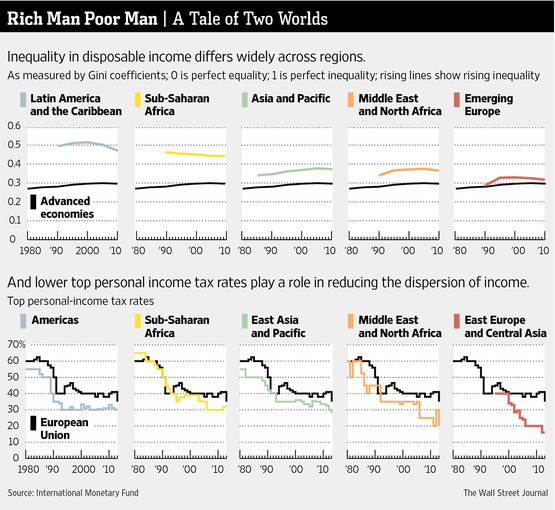

Along with advanced economies, income inequality has grown in the Middle East, in North Africa and in Asian countries. While the disparity has declined in Latin America and sub-Saharan Africa, it is still far higher in those regions than in the rest of the world.

Those trends are prompting the fund's top brass to champion the cause, as they hope to shape?or in some cases jump-start?public debates over policies for protecting the poor and redistributing wealth. For the fund, protests in Athens, Lisbon, Caracas and Tripoli in the past year are manifestations of the broader underlying reality of income inequality that public officials must address through careful calibration of tax and budget policies.

That is particularly important?and difficult?for governments to do as they also try to slash public debt. In the U.S., for example, health care, social security and other entitlement commitments in coming decades are expected to far outweigh the ability of the government to pay for them. A 2011 IMF paper estimated that just to contain future budget costs, the federal government would have to raise taxes by 35% and cut entitlement spending by an equal percentage.

The IMF's latest paper doesn't prescribe country-specific measures, but it does offer several proposals that are likely to be controversial. Most notably, the IMF says many advanced and developing economies can narrow inequality by more aggressively applying property taxes and "progressive" personal income taxes that rise as incomes increase.

The median top personal income-tax rate across the globe has halved since the 1980s to around 30%. But the IMF says "revenue-maximizing [personal income tax] rates are probably somewhere between 50% and 60% and optimal rates probably somewhat lower than that."

Remainder of article via the link.

WSJ Article

Updated March 13, 2014 8:28 p.m. ET

WASHINGTON--The world's top economic institution is sounding the alarm about a growing chasm between rich and poor, warning that rising income inequality is weighing on global economic growth and fueling political instability.

The International Monetary Fund's latest salvo came Thursday in a top official's speech and a 67-page paper detailing how the IMF's 188 member countries can use tax policy and targeted public spending to stem a rising disparity between haves and have-nots.

IMF Managing Director Christine Lagardehas made the issue a high priority for the fund, warning?along with some of the fund's most powerful shareholders?that inequality is threatening longer-run economic prospects. Last month, Ms. Lagarde said the income gap risked creating "an economy of exclusion, and a wasteland of discarded potential" and rending "the precious fabric that holds our society together."

The IMF is wading deep into a problem that no less than President Pope Francis have called a defining issue of our time, and the fund's potential prescriptions are likely to be a lightning rod for debate. They include raising taxes and redistributing wealth.

"Redistribution can help support growth because it reduces inequality," David Lipton, the fund's No. 2 official and a former senior White House aide, said in a speech Thursday at the Peterson Institute for International Economics. "But if misconceived, this trade-off can be very costly."

The IMF has a long history of studying economic disparities from an academic perspective. But the political turmoil spreading across Ukraine, Egypt and Venezuela in recent years underscores their real-world importance. In each of those countries, income inequality and poor economic management helped propel widespread unrest.

The financial crisis exacerbated the problem in rich nations. Surging joblessness after the 2008 financial meltdown gave traction to groups such as Occupy Wall Street and the Robin Hood Tax Campaign, a prominent nonprofit coalition seeking higher tax revenue to back programs benefiting poorer Americans.

Inequality in several advanced economies, including the U.S., has returned to levels not seen since before the Great Depression, the fund said. In Greece, the epicenter of Europe's debt woes for several years, the poorest 10% of the population was hit hardest by a cut in the tax-free threshold for income taxes, according to IMF data. Economic hardship there has been cited as a significant factor in the rising popularity of the fascist movement Golden Dawn and related violence against immigrants."There's a sense that the burdens of the crisis have been unevenly distributed, that the middle classes and the poor have footed more of the bill of the crisis than the economic elite," said Moises Naim, a senior economist at the Carnegie Endowment for International Peace and Venezuela's former trade minister.

Along with advanced economies, income inequality has grown in the Middle East, in North Africa and in Asian countries. While the disparity has declined in Latin America and sub-Saharan Africa, it is still far higher in those regions than in the rest of the world.

Those trends are prompting the fund's top brass to champion the cause, as they hope to shape?or in some cases jump-start?public debates over policies for protecting the poor and redistributing wealth. For the fund, protests in Athens, Lisbon, Caracas and Tripoli in the past year are manifestations of the broader underlying reality of income inequality that public officials must address through careful calibration of tax and budget policies.

That is particularly important?and difficult?for governments to do as they also try to slash public debt. In the U.S., for example, health care, social security and other entitlement commitments in coming decades are expected to far outweigh the ability of the government to pay for them. A 2011 IMF paper estimated that just to contain future budget costs, the federal government would have to raise taxes by 35% and cut entitlement spending by an equal percentage.

The IMF's latest paper doesn't prescribe country-specific measures, but it does offer several proposals that are likely to be controversial. Most notably, the IMF says many advanced and developing economies can narrow inequality by more aggressively applying property taxes and "progressive" personal income taxes that rise as incomes increase.

The median top personal income-tax rate across the globe has halved since the 1980s to around 30%. But the IMF says "revenue-maximizing [personal income tax] rates are probably somewhere between 50% and 60% and optimal rates probably somewhat lower than that."

Remainder of article via the link.

WSJ Article