Kudos for the "Ownership Society"?Michael Milken: How Housing Policy Hurts the Middle Class

Many buyers decided that the largest-possible house was a better idea than a retirement fund or a child's education.

By

Michael Milken, Wall Street Journal

March 5, 2014 6:39 p.m. ET

The American dream traditionally meant that

anyone could get ahead based on ability and hard work. But over the past

few decades, the United States government created incentives through

housing programs and the tax code that changed the dream for many

Americans. Middle-class families began to think of homes as investments,

not just shelter. When the housing market crashed, everyone

suffered?homeowners, investors, wage-earners and taxpayers.

Aggressive

housing programs have not always helped the poor and middle class. The

median net worth of American adults is now one of the lowest among

developed nations?less than $45,000, according to the

Global Wealth Databook. That compares with approximately $220,000

in Australia, $142,000 in France and $54,000 in Greece. Almost a third

of American adults have a net worth of less than $10,000. Those

statistics don't convey the pain endured by millions of American

families who lost their homes.

[/URL]

As recently as 1980, government-sponsored Fannie Mae and Freddie Mac

held, guaranteed or securitized fewer than 10% of U.S. mortgages

or less than $100 billion. Today, it's $4.7 trillion. Add Ginnie Mae's

mortgage guarantees, and the number exceeds $6 trillion. Since 2008,

these agencies have been involved in more than 95% of all new mortgages.

This massive exposure has been justified by cliches: Housing should be

affordable; ownership creates financial independence; government

programs sustain the economy by increasing ownership. But did ownership

increase?

According to the Census

Bureau, 65.6% of households owned a home in 1980. More than three

decades and trillions of dollars later, the needle hasn't budged?it's

still about 65%. Subsidized mortgages did create three things, none of

them good:

1. The largest housing price bubble in American history. Research by Nobel economist

Robert Schiller shows that U.S. housing prices declined in about half of the

years since 1890. While U.S. stocks during those years enjoyed an

average real rate of return of about 6% a year, the annual

inflation-adjusted return on houses was a meager 0.18%. Factor in real

estate's heavy transaction costs and that number turns negative.

Nevertheless, in the housing-boom decade before 2007, many buyers

decided that the largest-possible house (with an equally large mortgage)

was a better idea than a retirement fund or their children's education.

By

contrast, according to CLSA Asia-Pacific Markets, middle-class

households in 11 Asian nations spend an average 15% of income on

supplemental education for their children?nearly as much as the 16%

spent on housing and transportation combined. Americans spend only 2% on

supplemental education and 50% on housing and transportation. For

American home buyers taking on big loans, there was no margin for error

if they lost their job or the roof leaked.

2. Misguided economic priorities.

Uniquely among nations, the U.S. gives mortgage borrowers a trifecta of

benefits: extensive tax advantages, no recourse against the borrowers'

nonresidential assets if they walk away, and typically no protection for

the lender if the borrower prepays the loan to get a lower rate.

These policies long seemed like a

great deal for borrowers, but they wreaked havoc on the financial

system. People with marginal credit were encouraged to finance more than

90% of the purchase price with 30-year mortgages. If interest rates

later fell, they could refinance. If rates rose, they could congratulate

themselves for locking in a low rate. If prices rose, they enjoyed all

the upside and could tap the equity. If prices fell and they faced

foreclosure, their other assets were protected because the loans were

usually non-recourse.

The Consumer

Financial Protection Bureau now wants to tip the scale even more against

lenders by asserting the legal theory of "disparate impact." Consumers

can sue if the volume of loans to any racial group or aggrieved class

differs substantially from loans to other groups. No intent to

discriminate is required, and it's illegal for a mortgage application to

ask the borrower's race. Financial institutions trying to avoid making

bad loans by implementing prudent underwriting practices can

inadvertently get in trouble. A bank forced to pay a fine one year

because it irresponsibly made "predatory" loans to people with bad

credit can be fined the next year for not making similar loans.

3.Damage to the environment and public health.

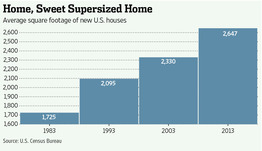

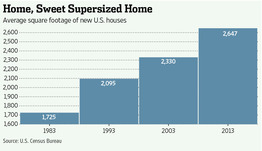

As the nearby chart indicates, the size of the average American house

grew by more than half?about 900 additional square feet?over the past

three decades while the number of people in the average house decreased.

Larger houses need larger lots that are usually farther from the home

owner's job. Construction, heating, cooling, landscaping and extended

commutes consume more natural resources. Because breadwinners spend more

time in cars, they have less time for their families.

As

someone who helped finance several of the nation's leading residential

builders, I understand the important role the industry plays in the

economy. Homebuilders didn't create the problems. Policies made in

Washington distorted the banking system and discouraged personal

responsibility by subsidizing loans that borrowers couldn't otherwise

afford. This encouraged housing speculation supported by financial

leverage. Ultimately, taxpayers got the bill.

Housing's

2008 collapse led to the U.S. Treasury takeover of Fannie's and

Freddie's obligations even as the Federal Housing Administration

increased its guarantees to more than $1 trillion and the Federal

Reserve stepped up purchases of mortgage-backed securities. Federal debt

surged.

Americans will eventually have

to pay for that through some combination of inflation, higher taxes,

higher interest rates or reduced benefits and services. For now, the Fed

is doing what the savings and loan industry did in the 1980s: borrowing

short term while lending long term. When interest rates rise, the value

of the government's mortgage holdings will decline.

Many

housing experts believe that the solution is to reduce the government's

role by attracting private capital. That's the centerpiece of proposals

presented to the Senate Banking Committee last fall by

Phillip Swagel,

a senior fellow at the Milken Institute's Center for Financial

Markets. Rather than hold or securitize mortgages, Fannie and Freddie

would retain only a limited role as secondary guarantors. With the

government as a backstop and private capital risking the first loss,

mortgage interest rates would undoubtedly rise. But the taxpayer subsidy

would fall. It's a reasonable tradeoff to transfer risk from taxpayers

to investors and let the market determine rates. Congress appears to be

moving in that direction as it debates various proposals.

Fortunately,

the private sector is well-positioned to assume much of the

government's role. Thanks to booming capital markets and accommodative

central banks, there is tremendous liquidity worldwide. Fannie and

Freddie have now paid the Treasury more in dividends than they received

in the bailout. Private capital already plays a substantial role in

commercial real estate and has the capacity to make comparable

residential commitments.

Investments in

quality education and improved health will do more to accelerate

economic growth than excessive housing incentives. That will give

everyone a better chance to achieve the real American dream.

Mr. Milken

is chairman of the Milken Institute.

Many buyers decided that the largest-possible house was a better idea than a retirement fund or a child's education.

By

Michael Milken, Wall Street Journal

March 5, 2014 6:39 p.m. ET

The American dream traditionally meant that

anyone could get ahead based on ability and hard work. But over the past

few decades, the United States government created incentives through

housing programs and the tax code that changed the dream for many

Americans. Middle-class families began to think of homes as investments,

not just shelter. When the housing market crashed, everyone

suffered?homeowners, investors, wage-earners and taxpayers.

Aggressive

housing programs have not always helped the poor and middle class. The

median net worth of American adults is now one of the lowest among

developed nations?less than $45,000, according to the

Global Wealth Databook. That compares with approximately $220,000

in Australia, $142,000 in France and $54,000 in Greece. Almost a third

of American adults have a net worth of less than $10,000. Those

statistics don't convey the pain endured by millions of American

families who lost their homes.

[/URL]

As recently as 1980, government-sponsored Fannie Mae and Freddie Mac

held, guaranteed or securitized fewer than 10% of U.S. mortgages

or less than $100 billion. Today, it's $4.7 trillion. Add Ginnie Mae's

mortgage guarantees, and the number exceeds $6 trillion. Since 2008,

these agencies have been involved in more than 95% of all new mortgages.

This massive exposure has been justified by cliches: Housing should be

affordable; ownership creates financial independence; government

programs sustain the economy by increasing ownership. But did ownership

increase?

According to the Census

Bureau, 65.6% of households owned a home in 1980. More than three

decades and trillions of dollars later, the needle hasn't budged?it's

still about 65%. Subsidized mortgages did create three things, none of

them good:

1. The largest housing price bubble in American history. Research by Nobel economist

Robert Schiller shows that U.S. housing prices declined in about half of the

years since 1890. While U.S. stocks during those years enjoyed an

average real rate of return of about 6% a year, the annual

inflation-adjusted return on houses was a meager 0.18%. Factor in real

estate's heavy transaction costs and that number turns negative.

Nevertheless, in the housing-boom decade before 2007, many buyers

decided that the largest-possible house (with an equally large mortgage)

was a better idea than a retirement fund or their children's education.

By

contrast, according to CLSA Asia-Pacific Markets, middle-class

households in 11 Asian nations spend an average 15% of income on

supplemental education for their children?nearly as much as the 16%

spent on housing and transportation combined. Americans spend only 2% on

supplemental education and 50% on housing and transportation. For

American home buyers taking on big loans, there was no margin for error

if they lost their job or the roof leaked.

2. Misguided economic priorities.

Uniquely among nations, the U.S. gives mortgage borrowers a trifecta of

benefits: extensive tax advantages, no recourse against the borrowers'

nonresidential assets if they walk away, and typically no protection for

the lender if the borrower prepays the loan to get a lower rate.

These policies long seemed like a

great deal for borrowers, but they wreaked havoc on the financial

system. People with marginal credit were encouraged to finance more than

90% of the purchase price with 30-year mortgages. If interest rates

later fell, they could refinance. If rates rose, they could congratulate

themselves for locking in a low rate. If prices rose, they enjoyed all

the upside and could tap the equity. If prices fell and they faced

foreclosure, their other assets were protected because the loans were

usually non-recourse.

The Consumer

Financial Protection Bureau now wants to tip the scale even more against

lenders by asserting the legal theory of "disparate impact." Consumers

can sue if the volume of loans to any racial group or aggrieved class

differs substantially from loans to other groups. No intent to

discriminate is required, and it's illegal for a mortgage application to

ask the borrower's race. Financial institutions trying to avoid making

bad loans by implementing prudent underwriting practices can

inadvertently get in trouble. A bank forced to pay a fine one year

because it irresponsibly made "predatory" loans to people with bad

credit can be fined the next year for not making similar loans.

3.Damage to the environment and public health.

As the nearby chart indicates, the size of the average American house

grew by more than half?about 900 additional square feet?over the past

three decades while the number of people in the average house decreased.

Larger houses need larger lots that are usually farther from the home

owner's job. Construction, heating, cooling, landscaping and extended

commutes consume more natural resources. Because breadwinners spend more

time in cars, they have less time for their families.

As

someone who helped finance several of the nation's leading residential

builders, I understand the important role the industry plays in the

economy. Homebuilders didn't create the problems. Policies made in

Washington distorted the banking system and discouraged personal

responsibility by subsidizing loans that borrowers couldn't otherwise

afford. This encouraged housing speculation supported by financial

leverage. Ultimately, taxpayers got the bill.

Housing's

2008 collapse led to the U.S. Treasury takeover of Fannie's and

Freddie's obligations even as the Federal Housing Administration

increased its guarantees to more than $1 trillion and the Federal

Reserve stepped up purchases of mortgage-backed securities. Federal debt

surged.

Americans will eventually have

to pay for that through some combination of inflation, higher taxes,

higher interest rates or reduced benefits and services. For now, the Fed

is doing what the savings and loan industry did in the 1980s: borrowing

short term while lending long term. When interest rates rise, the value

of the government's mortgage holdings will decline.

Many

housing experts believe that the solution is to reduce the government's

role by attracting private capital. That's the centerpiece of proposals

presented to the Senate Banking Committee last fall by

Phillip Swagel,

a senior fellow at the Milken Institute's Center for Financial

Markets. Rather than hold or securitize mortgages, Fannie and Freddie

would retain only a limited role as secondary guarantors. With the

government as a backstop and private capital risking the first loss,

mortgage interest rates would undoubtedly rise. But the taxpayer subsidy

would fall. It's a reasonable tradeoff to transfer risk from taxpayers

to investors and let the market determine rates. Congress appears to be

moving in that direction as it debates various proposals.

Fortunately,

the private sector is well-positioned to assume much of the

government's role. Thanks to booming capital markets and accommodative

central banks, there is tremendous liquidity worldwide. Fannie and

Freddie have now paid the Treasury more in dividends than they received

in the bailout. Private capital already plays a substantial role in

commercial real estate and has the capacity to make comparable

residential commitments.

Investments in

quality education and improved health will do more to accelerate

economic growth than excessive housing incentives. That will give

everyone a better chance to achieve the real American dream.

Mr. Milken

is chairman of the Milken Institute.